Deals

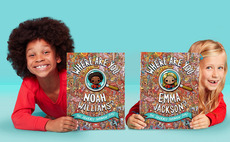

Graphite Capital acquires Wonderbly

Personalised children's books publisher is the seventh deal from Graphite's 2018-vintage ninth fund

Mega-rounds fuel record H1 for venture and growth

Largest rounds inked in the first six months of 2021 read like a veritable Who's Who of European fintech heavyweights

Trilantic invests in Smile Eyes

Trilantic intends to pursue a buy-and-build strategy for the German ophthalmology clinic chain

Alpha Private Equity sells Vertbaudet to Equistone

SBO of the children's clothing and accessories retailer is Equistone's sixth platform deal of 2021

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Bayer ESP eyed by Bain, Cinven ahead of post-summer sale launch

Bayer could expect to fetch in excess of EUR 2bn for ESP, two sources say

IGI to assess strategic options for Nuovaplast

Manufacturer of PET preforms Nuovaplast attracted unsolicited approaches by European industry players

Apax advised by UBS on Wehkamp exit

Dutch online warehouse Wehkamp is expected to come to market in H2 2021

Palamon exits Feelunique in GBP 132m sale to Sephora

Palamon acquired the UK-headquartered online beauty products retailer for GBP 26m in 2012

PE buy-side appetite further boosts exit options for sponsors

Secondary buyouts accounted for nearly a third of all PE exits in the first half of 2021, compared with typical levels of 20-25%

EQT explores strategic options for Banking Circle

Options include a private sale and a merger with a blank-cheque company, as well as a listing via IPO

KKR readies German auto parts maker Tekfor for September sale

KKR attempted to exit Tekfor around two years ago in a sale process that was ultimately inconclusive

Ardian buys stake in Nova Reperta

Investment in the management consultancy is Ardian Growth's first investment in Belgium

De Cecco attracts interest from ProA Capital, denies talks

Private equity firm is keen on acquiring a minority interest in the pasta maker, sources say

A&M Capital Europe buys Pet Network for EUR 260m

Pet Network was created by TRG in 2018 through the acquisition and merger of three businesses

FPE invests in employee benefits software Zest

Deal is the 10th platform investment from FPE's GBP 100m, 2016-vintage, second fund

Palatine sells Wren Sterling in Lightyear-backed MBO

Wren Sterling was created in 2015 through the Palatine-backed MBO of Towergate Financial

New French GP Aldebaran holds first close for debut fund

Aldebaran Transformation Fund I targets EUR 300m for complex buyout situations

EQT's Cerba buys Lifebrain from Investindustrial

Parties agreed on a price of more than EUR 1bn, with exclusivity awarded last week

Keensight exits Asti Mobile Robotics to trade

GP bought a stake in the autonomous mobile robots developer in 2019 via its 2014-vintage fourth fund

Investindustrial's Lifebrain nears sale to Cerba HealthCare

Parties are in final-stage talks, with signing set to take place in the next couple of days

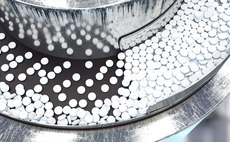

BC sells Pharmathen to Partners Group in EUR 1.6bn deal

BC Partners acquired the Greece-headquartered generic pharmaceuticals developer in 2015 for EUR 475m

Equistone acquires GSCM Group

GP has previous experience in the modular construction sector with Oikos Group

IK buys Blanchon from Abénex

First investment made from IK Small Cap III Fund, which closed in April 2021 on EUR 1.2bn