PE buy-side appetite further boosts exit options for sponsors

European private equity players' strong appetite to deploy has noticeably boosted the prevalence of secondary buyouts as an exit route this year, according to Unquote Data.

With a number of sponsors initiating a raft of exit processes on the back of renewed confidence, and even more GPs eager to deploy at pace following a couple of sedate quarters last year, it is no surprise that private equity houses have been more than happy to trade assets between themselves in the first half.

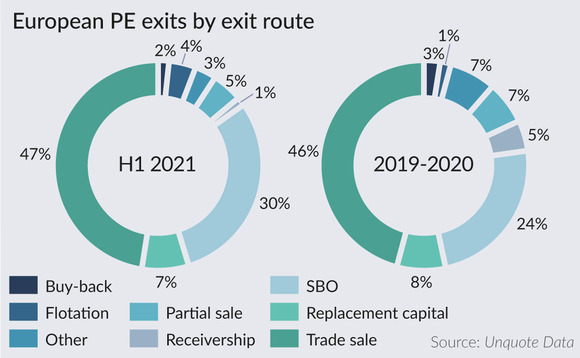

Secondary buyouts accounted for nearly a third (30%) of all PE exits in volume terms in the first half of 2021, according to Unquote Data - over the 2019-2020 period, that proportion stood at 24%.

Overall, exits of European PE-backed assets continued their strong rebound in H1 on the back of a buoyant M&A environment. Unquote recorded 603 realisations between January and June, a considerable step-up from the 512 exits seen in H2 2020 and the 422 realisations recorded in H1 2020. Exit activity has even surpassed the very busy second half of 2019 (579 deals).

But while trade sales have ramped up in line with the general exit uptick, and remain the most well-trodden avenue for sponsors to realise assets, secondary buyout dealflow has increased at a faster rate so far in 2021. Unquote recorded 183 such exits in the first half, compared with 127 in H2 last year. The figure is also higher than the previous high point of 163 exits to a fellow GP seen in H1 2018.

As ever, France was particularly fertile ground for "pass-the-parcel" deals. Nearly half (47%) of French buyouts have been sourced from fellow private equity houses in 2021 so far, Unquote Data shows. This is well above the 27% figure seen across the rest of Europe in the same timeframe.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds