Mega-rounds fuel record H1 for venture and growth

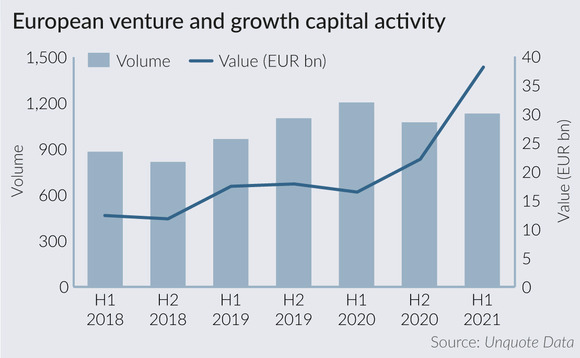

Europe was home to a record EUR 38bn's worth of venture and growth capital investment in the first half of 2021, shattering previous records, according to Unquote Data.

European venture and growth capital was the only market segment that thrived rather than go backwards in the first half of 2020, while buyout processes were severely impacted by the coronavirus outbreak. According to Unquote Data, the venture space was hit later in the year, with H2 2020 marking a modest -10% step back in volume terms after months of growth.

So far, 2021 is showing strong signs of a healthy rebound. Investment volume crept up by 5% to hit 1,131 deals covered by Unquote across Europe in H1, inching closer to the previous record of 1,200 rounds seen in the first half of 2020.

But the aggregate value of these investments can be best described as a quantum leap: the EUR 38.17bn total of H1 2021 is a 72% increase on the EUR 22.14bn tallied up in the second half of 2020, and around double the amounts recorded in each half of 2019.

A glance at the number of rounds in excess of EUR 200m (and the sheer size of the largest of these) goes a long way towards explaining the massive value hike. Unquote recorded no fewer than 45 of these in H1 2021 alone, against 22 and 26 over the whole of 2020 and 2019, respectively.

The largest rounds inked in the first six months of 2021 read like a veritable Who's Who of European fintech heavyweights. Among these, Germany-based mobile-only broker Trade Republic raised a EUR 700m Series C funding round giving the company a valuation of USD 5.3bn (EUR 4.3bn); Blackstone Growth led a $800m (€665m) Series C for Netherlands-based e-payments software firm Mollie at a valuation of USD 6.5bn (EUR 5.4bn); SoftBank led a USD 639m funding round for Sweden-based Klarna, valuing the fintech business at USD 45.6bn; and Target Global led a USD 650m Series C for Germany-based digital insurance provider Wefox, which was valued at around USD 3bn post-money.

Star companies in other sectors attracted significant amounts of capital too, such as CMR Surgical, a UK-based surgical robotics business, raising USD 600m in yet another mega-round led by SoftBank – the Series D valued the business at around USD 3bn. Getir, the Turkey-based developer of a mobile app that provides delivery services for groceries, raised USD 550m in a Series D funding round co-led by Sequoia Capital and Tiger Global.

The signs of a market increasingly driven by late-stage mega-rounds were already there in the quieter H2 2020: despite a fall in investment volume compared to the first six months of that year, aggregate value jumped by nearly a third. And recent news from July would indicate the enthusiasm is not dying down: among others, UK-based payments and banking platform Revolut raised USD 800m in its Series E funding round at a valuation of USD 33bn, while online marketplaces CarNext and ManoMano raised EUR 400m and USD 355m respectively.

"The venture space is incredibly buoyant," says a UK-based tech investor. "During the pandemic, a lot of the companies active in tech, healthcare and remote working saw exponential growth. We are now seeing exceptional dealflow, as are others, and lots of investment in later-stage deals where it is getting really competitive."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds