Deals

Linnaeus leads $3m round for M2fx

Linnaeus Capital Partners has led a $3m funding round for UK-based fibre cable protection manufacturer M2fx.

Baring Private Equity Partners backs Grupotec

Spanish investor Baring Private Equity Partners is believed to have injected fresh capital into Valencian engineering firm Grupotec.

Balderton Capital et al. invest $13.4m in Urturn

Balderton Capital has led a series-A fundraising round of $13.4m for Urturn, a UK social media platform.

Lundin exits Vostok Nafta to Luxor Capital

Lundin, via Lorito Holdings Ltd and Zebra Holdings and Investments Ltd, has exited Vostok Nafta Investment Ltd to Luxor Capital.

Charterhouse enters Italian market, buys Doc Generici

Charterhouse Capital Partners has wholly acquired Italian pharmaceutical firm Doc Generici, marking the GP’s first transaction in the Italian market, according to reports.

Weinberg's Alliance Industrie acquires Précisium

Weinberg Capital Partners-backed Alliance Industrie has acquired a majority stake in parts trader Précisium Groupe, in a deal that saw European Capital Financial Services provide €4m in mezzanine loans.

Industrifonden, Zobito et al. invest SEK 20m in Qwaya

Industrifonden and Zobito have joined previous owners to invest SEK 20m in Swedish social media advertising business Qwaya.

Phagenesis expands series-B round to $17m

Phagenisis has extended its series-B funding round to reach $17m.

Beringea invests £1.5m in Monica Vinader

Beringea and private family business The Clark Group have invested ТЃ2.5m in high-end jewellery retailer Monica Vinader.

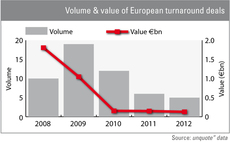

Turnaround deals hit five-year low

Turnaround deals

HealthCap, Industrifonden et al. back Oncopeptides

HealthCap, Industrifonden and other investors have taken part in a series-A financing round for Swedish medical start-up Oncopeptides AB.

Mig et al. add €9.5m to SuppreMol series-D round

Mig AG and BioMed Partners have injected an additional €9.5m into Germany-based SuppreMol alongside a number of other backers in an extension of the company’s series-D funding round.

TowerBrook buys majority stake in Kaporal 5

TowerBrook Capital Partners has acquired a majority stake in French clothing retailer Kaporal 5.

Cloetta acquires Goody Good Stuff

Nordic Capital- and Cidron-backed Cloetta AB has acquired UK-based candy company Goody Good Stuff.

Ace invests €8m in Asquini-Sofop Aero

Ace Management has made an €8m investment to back the merger of French aerospace parts manufacturers Asquini and Sofop.

3i reaps 2.3x on Xellia exit

3i has agreed to sell Xellia Pharmaceuticals AS, a Norwegian speciality pharmaceutical group, to Novo AS for ТЃ460m.

Kick Sport receives additional investment from Catapult

Midlands-based Catapult Venture Managers has invested ТЃ250,000 in UK online martial arts retailer Kick Sport.

NPM buys 25% of FibreMax

NPM Capital has acquired a 25% stake in Dutch lightweight precision cable manufacturer FibreMax.

Infinity partially exits Positive Cashflow Finance

Infinity Asset Management has partially exited its 2007 investment in invoice finance provider Positive Cashflow Finance through a funding line from RBS Invoice Finance (RBSIF) and NatWest.

Cross Equity Partners divests Schwab

Swiss GP Cross Equity Partners has sold its majority stake in shock absorption systems firm Schwab Verkehrstechnik AG to Parisian rail systems company Faveley.

Oxford Capital et al. in $3m Celoxica round

Oxford Capital Partners has led a $3m funding round for London-based ultra-low latency market data provider Celoxica.

Idinvest backs Forsee Power Solutions

Idinvest Partners has provided growth capital to rechargeable industry-grade battery specialist Forsee Power Solutions.

DN Capital leads series-A round for Scarosso

DN Capital, IBB, Perikles Ventures and local angel investors have provided German footwear business Scarosso with a series-A round of funding.

Swedish venture faces critical funding gap

When it comes to venture capital, opportunities abound in Sweden. Yet, despite the success stories, a critical funding gap threatens the future of the industry. Amy King reports