Deals

Target Partners exits JouleX in $107m trade sale

Target Partners has sold its stake in IT energy management company JouleX Inc to US high-tech business Cisco.

TPG and VTB consider Lenta listing in London

TPG and VTB Capital are in talks with banks concerning a possible London listing of Russian supermarket chain Lenta.

Sun European halts sale of DBApparel

Sun European Partners has abandoned the attempted sale of DBApparel, the parent company of French underwear retailer Dim, due to a lack of sufficient offers for the business, according to French media.

Catalyst Investors backs Reputation Institute

Catalyst Investors has completed a minority equity investment in Danish corporate reputation measurement firm Reputation Institute.

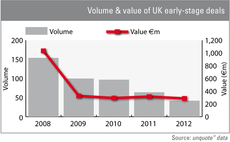

Value of UK early-stage investments holds steady

UK early-stage deal numbers are dropping off, but the total value invested has held steady over the last four years.

Industrifonden et al. back Flexenclosure

Industrifonden, Andra AP-fonden (AP2) and International Finance Corporation (IFC) have invested SEK 160m in Swedish information and communications technology infrastructure provider Flexenclosure.

Fountain Healthcare backs €9.2m Trino Therapeutics round

Fountain Healthcare Partners has invested in a тЌ9.2m series-A funding round for Ireland-based Trino Therapeutics Ltd, alongside British grant-giving body Wellcome Trust.

Octopus leads £2.95m investment in Conversocial

Octopus has led a ТЃ2.95m investment round for social media management software company Conversocial.

Globalscope M&A network expands

Globalscope, a network of M&A practitioners, has admitted five new partner firms, bringing Poland and Greece into its reach.

Main Capital exits Iaso in trade sale

Main Capital Partners has exited Netherlands-based Iaso Backup Technology to US-based trade player GFI Software in a “double-digit-million-euro transaction”.

Prometheus in partial Pandora exit

Prometheus Invest ApS has agreed to sell 13 million shares in Pandora AS to institutional investors for DKK 2.6bn.

LDC backs MBO of Node4

LDC has backed the management buyout of UK-based IT and communications services provider Node4 Ltd.

British Gas leads £7m investment in 4energy

British Gas has led a ТЃ7m investment in 4energy alongside existing investors Environmental Technologies Fund (ETF), Carbon Trust Investments and Catapult Venture Managers.

Nazca buys Agromillora

Nazca Capital has acquired Spanish plant propagation firm Agromillora.

Axa PE and Fosun to acquire Club Med for €540m

Axa Private Equity and Fosun International have agreed to wholly acquire listed French holiday resorts group Club Méditerranée alongside the company's management for around €540m.

ACT et al. invest $5.2m in Cubic Telecom

ACT Venture Capital, Enterprise Ireland, TPS Investments and US telecoms giant Qualcomm have jointly invested $5.2m in Dublin-based global connectivity specialist Cubic Telecom.

Ratos acquires majority stake in Hent for NOK 310m

Ratos has agreed to acquire close to 73% of Norwegian construction company Hent for NOK 310m.

Diana sale could yield €1bn for Axa PE

Axa Private Equity is mulling a sale for French food ingredients business Diana Ingredients, according to reports.

AAA raises €4.8m from Seventure et al.

French pharmaceutical firm Advanced Accelerator Applications (AAA) has raised €4.8m from existing and new investors, including incoming venture capital investor Seventure Partners.

Maven, Connection reap 1.8x on Atlantic Foods sale

Maven Capital Partners and Connection Capital have sold their stake in Atlantic Foods Group to Flagship Food Group LLC, a US trade buyer.

Nordic Capital and CVC sell Cloetta shares

Nordic Capital and CVC Capital Partners have partially exited Swedish confectionery company Cloetta AB.

CVC to list bpost shares in IPO

CVC Capital Partners plans on listing a minority portion of its shares in Belgian postal service bpost in the business's upcoming IPO on the NYSE Euronext in Brussels.

Mid Europa acquires Polish Cable Railways for PLN 215m

Mid Europa Partners has wholly acquired Polish Cable Railways (PKL), Poland’s oldest cable car provider, from the state-owned Polish State Railways (PKP) group for PLN 215m.

Monetising life sciences deals

Life sciences