Deals

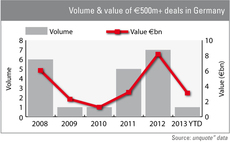

Germany: large-cap deals on the rise

CVC’s €3.1bn buy-back of German metering business Ista this month has sparked speculation about a revival of Germany’s large-cap market.

Bridgepoint leads Cote auction

Bridgepoint has emerged as the front-runner in the bidding process for UK-based restaurant chain Cote, which is expected to sell for ТЃ100m, according to reports.

Zukunftsfonds Heilbronn, HTGF et al. back Compositence

Zukunftsfonds Heilbronn has become the lead investor in German carbon-fibre components company Compositence following a capital increase round that also included fresh investment from High-Tech Gründerfonds (HTGF) and Mittelständische Beteiligungsgesellschaft...

Better Capital acquires City Link for £1

Turnaround player Better Capital has bought UK courier company City Link Ltd from Rentokil Initial plc through its Becap12 fund for a symbolic ТЃ1.

German activity sluggish despite mega-deals

German activity

Mobeus in ATG Media bolt-on

Mobeus Equity Partners has made an add-on investment of ТЃ4.5m in portfolio company ATG Media to finance the acquisition of US-based online auctions site BidSpotter Inc.

Fortis PE and Next Invest sell Arets to Toyo Ink for €10m

Fortis Private Equity and asset manager Next Invest have sold their joint 100% stake in Belgian ink manufacturer Arets International to Japanese ink company Toyo Ink Group for €10m.

Cinven and Warburg Pincus in final exit from Ziggo

Cinven and Warburg Pincus have reaped €3.4bn on their full exit from Ziggo, the Dutch cable operator that the firms took public on NYSE Euronext in Amsterdam last year.

Intel buys Aepona from Amadeus et al.

Aepona, a cloud-based telecom network solutions company backed by several venture investors, has been sold to Intel.

Ace Management buys Auvergne Aéronautique group

Ace Management has wholly acquired Slicom Aéronautique, Auvergne Aéronautique Slicom and Casablanca Aéronautique from Slicom International, with a view to turn the businesses around.

VC-backed GetYourGuide acquires Gidsy

GetYourGuide, a portfolio company of Profounders Capital, Spark Capital and Highland Capital Partners Europe, has acquired Berlin-based Gidsy, a peer-to-peer platform backed by Sunstone Capital, Index Ventures and private investors.

DBAG invests in Inexio

Deutsche Beteiligungs AG (DBAG) has invested €10.6m of growth capital in German broadband connections provider Inexio Informationstechnologie und Telekommunikation KGaA.

UK government considers private equity route for Royal Mail

CVC, Carlyle and KKR are among the firms that have been approached by government advisers regarding a potential buyout of Royal Mail, according to media reports.

Inveready enjoys 50% IRR on 3Scale partial exit

Spanish investor Inveready has partially exited 3Scale, a technology solutions provider, following a $4.2m capital injection into the firm from US investors.

H2 Equity Partners sells Sator to LKQ

H2 Equity Partners has sold Dutch portfolio company Sator Holding to UK-based auto parts distributor Euro Car Parts for £176m.

Eurazeo cashes in on early Danone exit

French listed private equity player Eurazeo will part ways with dairy products giant Danone as €700m's worth of exchangeable Danone bonds, issued in 2009, are set to be converted to equity.

Yellow&Blue et al. back Romo Wind

Yellow&Blue Investment Management, ABB Technology Ventures and b-to-v Partners have invested €4.8m in Swiss wind farm optimisation company Romo Wind, alongside the business's founders.

Nauta leads €1.6m round for Marfeel

Nauta Capital has led a €1.6m round for Marfeel, a solutions provider to the web publishing industry.

CVC's Evonik begins listing process in Frankfurt and Luxembourg

CVC-backed Evonik Industries has begun its much anticipated listing process by issuing its 466 million shares simultaneously in Frankfurt and Luxembourg.

Argos Soditic buys Natural Distribution

Argos Soditic has backed the buy-in management buyout (BIMBO) of UK-based food supplements specialist Natural Distribution.

Main Capital acquires Connexys

Main Capital Partners has acquired a majority stake in Dutch software company Connexys.

ICG buys Euro Cater from Altor

Intermediate Capital Group (ICG) has bought Danish food service company Euro Cater in a secondary buyout from Altor Equity Partners and inco Amba.

BayBG joins HTGF and Bayern Kapital in €1m GME series-A

BayBG has joined existing investors High-Tech Gründerfonds (HTGF) and Bayern Kapital in a €1m series-A round for German laser and light systems provider German Medical Engineering (GME), alongside private investors.

Intel Capital et al. back $12m Gengo funding round

Intel Capital, Iris Capital, Infocomm Investments, NTT Docomo Innovation Ventures, ST Ventures and Atomico have invested in a $12m series-B funding round for Tokyo-based translation platform Gengo.