Deals

SBOs set to rebound

The recent quaternary buyout of French eyewear retailer Alain Afflelou by Lion Capital for an estimated €780m shows that the "pass-the-parcel" trend in private equity has not yet abated.

Matrix reaps 17.8x on Camwood

Matrix Private Equity Partners and Foresight Group have sold their original stake in Camwood, an IT services business, in a sale back to management.

Montagu acquires CAP

Montagu Private Equity has bought Leeds-based CAP, a provider of information to the automotive industry, for an estimated ТЃ175m.

Serena and Partech back Lafourchette

Serena Capital and Partech International have contributed to an €8m funding round for French online restaurant reservation service Lafourchette.

Accel leads $75m funding round for AVITO.ru

Accel Partners, Baring Vostok Private Equity Fund IV, Kinnevik and Northzone have invested $75m in Russian classifieds website AVITO.ru.

BGF injects £3.85m into M Squared Lasers

Business Growth Fund (BGF) has invested ТЃ3.85m for a minority stake in Glaswegian laser and detection technology company M Squared Lasers.

Milestone reaps 6x money on Cadum trade sale

Milestone Capital has reaped around 6x its money on the sale of French soap and baby products company Cadum to L’Oreal.

Langholm acquires Purity Soft Drinks in MBI

Langholm Capital has backed Gary Nield and Peter Unsworthтs management buy-in of Purity Soft Drinks from long-time owners the Cox family.

Lion Capital buys Alain Afflelou

Lion Capital has entered exclusive talks to acquire French eyewear retailer Alain Afflelou from Bridgepoint, Apax France and Altamir Amboise in a deal believed to be valued at nearly €800m.

Doughty Hanson acquires Grupo Hospitalario Quirón

Doughty Hanson has agreed to acquire a stake of around 40% in Spanish hospital group Grupo Hospitalario Quirón from current owners the Cordón Muro family, who will retain the remaining shares.

Caird Capital exits Bifold to LDC for £85m

Caird Capital has exited gas pumps manufacturer Bifold Group to LDC in a ТЃ85m deal yielding a 3x return for the seller, according to a source close to the deal.

Palamon concludes £23m refinancing of Cambridge Education Group

Palamon Capital Partners has completed a ТЃ23m refinancing deal for its portfolio company Cambridge Education Group (CEG) with Royal Bank of Scotland.

Vitruvian leads $64m round for Just-Eat

Vitruvian Partners has led a $64m funding round for London-based online takeaway ordering service Just-Eat.

Vesalius Biocapital leads €2.7m financing round for Trinean

Vesalius Biocapital, Capital-E, Baekeland II Fund and Fidimec have invested €2.7m in Belgian biotechnology business Trinean.

Terra Firma buys Four Seasons for £825m

Terra Firma has acquired British elderly and specialist care provider Four Seasons for ТЃ825m.

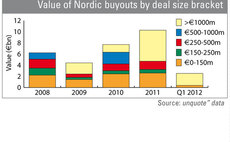

Nordics see strongest first quarter since Lehman

Despite reputational, regulatory, and macroeconomic concerns lingering from the second half of 2011, the Nordics has experienced its strongest first quarter since Lehman Brothers collapsed and brought the global economy to its knees.

Reiten & Co exits Ellipse Klinikken

Reiten & Co Capital Partners has exited cosmetic treatments provider Ellipse Klinikken to Swedish private clinic chain Akademikliniken.

Nordics seen as investment safe haven

The тЌ1.8bn sale of Ahlsell to CVC Capital Partners in February drew renewed attention to the thriving Nordic buyout market.

Accell Group buys Perseus's Raleigh Cycle for $100m

Perseus Capital and Raleigh Cycle's management have sold the British bicycle business for $100m to Dutch trade player Accell.

HTGF invests in futalis

High-Tech Gründerfonds has provided German dog food business futalis with seed financing of €500,000.

French turnarounds suffer from narrow GP base

As in most European countries, one could have thought that the morose economic environment would be a boon for French turnaround specialists.

Vendis Capital invests in Yarrah Organic Petfood

Vendis Capital has backed Dutch organic pet food producer Yarrah Organic Petfood.

Incitia backs Campadre

Incitia Ventures has taken a minority stake in Swedish online private sales company Campadre Scandinavia.

CVC acquires AlixPartners

CVC Capital Partners has acquired a majority stake in corporate advisory firm AlixPartners from private equity owner Hellman & Friedman.