Deals

GCP acquires Garrets International

Greenhill Capital Partners has acquired Essex-based marine catering management business Garrets International for a reported ТЃ17m.

Nordic Capital in Bladt SBO

Nordic Capital has acquired Danish steel contractor Bladt from Maj Invest and Industri Udvikling.

Better Capital buys Everest for £25m

Turnaround specialist Better Capital has acquired a 95% in stake in UK-based home improvement products manufacturer Everest in an all-equity, ТЃ25m transaction.

AnaCap buys international division of IFG for €84m

AnaCap has agreed to acquire the international division of financial services company IFG Group for тЌ84m.

Gilde acquires Sovitec from Value Enhancement Partners

Gilde Buyout Partners has bought Belgian manufacturing business Sovitec from Dutch private equity firm VEP.

Sambrinvest joins €23.6m series-B round in bioscience

Sambrinvest has joined Mitsui Global Investment, Shire, ATMI and the Boehringer Ingelheim Venture Fund to invest €17m in Belgian cell therapy company Promethera Biosciences. The Walloon region has granted a further €6.6m in the form of a loan.

FSN Capital exits VIA Travel

FSN Capital has exited travel management company VIA Travel to NASDAQ-listed trade player Expedia's subsidiary, Egencia.

Triton picks up Nordic Tankers business

Triton Partners has acquired the chemical tanker business of distressed ship owner Nordic Tankers.

Ashridge back special needs care provider Phoenix

Ashridge Capital has invested ТЃ3.5m in a management buyout of special needs care provider Phoenix Learning and Care.

Cornerstone buys ACTech from Halder

Cornerstone Capital and Premium Equity Partners have acquired Halder’s 80% stake in German metal parts manufacturer ACTech for an undisclosed price. The management retains its 20% stake.

Hedge funds: A new source of dealflow

The credit crisis has left hedge funds holding on to unwanted equity stakes. Could this be a new source of dealflow for private equity buyers? Sonnie Ehrendal investigates

Catapult invests in logistics company

Catapult Venture Managers has contributed ТЃ1.3m to a management buyout of specialist technology outsourcing and logistics company echo.

Entrepreneur Venture invests in Société Financière JF3H

Entrepreneur Venture has made a growth capital investment in Société Financière JF3H, the holding company of French coach travel operators Regnault Autocars and Nouvelle Aisne Tourisme.

Terra Firma buys Garden Centre for £276m

Terra Firma Capital Partners has acquired British garden centre operator The Garden Centre Group from Lloyds for a total of ТЃ276m in equity and debt.

PE-backed MBI for ACB

Europe et Croissance and Arkéa Capital Investissement have backed the management buy-in of Belgian circuit boards manufacturer Advanced Circuit Boards (ACB).

CEE's mid-market boom

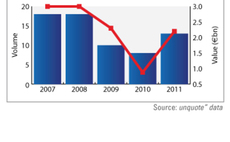

CEE activity was subdued but with encouraging signs in 2011. Q1 saw just €1.7bn clocked up, but this was twice the sum of the whole of the previous year. Also, although activity in H2 was quiet, year-end figures nearly doubled to €2.6bn year-on-year....

Fresh €1.5m round for Novapost

Existing investors including Alven Capital and Fa Dièse have contributed to a €1.5m funding round for French electronic HR solutions provider Novapost.

Panoramic Growth injects £1m in Dog Digital

Scottish venture capital firm, Panoramic Growth Equity, has invested ТЃ1m in digital communications agency Dog Digital Limited.

Imperial Innovations leads £3m funding round in Abingdon Health

Imperial Innovations Group has led a ТЃ3m funding round in Abingdon Health, a specialist medical diagnostics company, alongside other private investors.

CDC Entreprises et al. in €7m round for E-Blink

CDC Entreprises has joined existing shareholders 360 Capital Partners, Masseran Gestion, I-Source Gestion and Alven Capital Partners in a €7m round for French telecoms company E-Blink.

HIG Europe acquires Brand Addition

HIG Europe Capital Partners has acquired Brand Addition and its subsidiary, Kreyer Promotion Service, from 4imprint in a ТЃ24m deal.

LDC backs Airline Services MBO

LDC has backed the MBO of aircraft maintenance company Airline Services.

HTGF invests in MediaMetrics

High-Tech Gründerfonds has invested €500,000 in Berlin-based solution software provider MediaMetrics.

Seventure and Lundbeckfond inject €5m in Enterome

Seventure Partners and Lundbeckfond Ventures have provided French biotech company Enterome with a €5m series-A round of funding.