CEE's mid-market boom

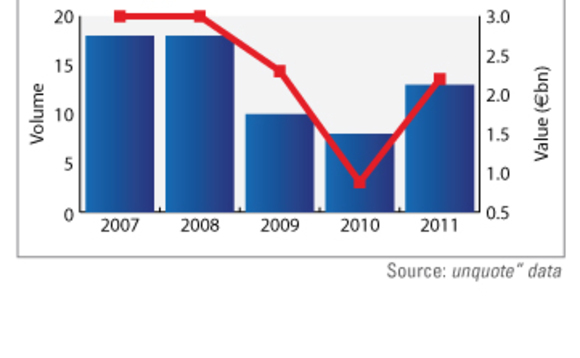

CEE activity was subdued but with encouraging signs in 2011. Q1 saw just €1.7bn clocked up, but this was twice the sum of the whole of the previous year. Also, although activity in H2 was quiet, year-end figures nearly doubled to €2.6bn year-on-year.

The mid-market was particularly dynamic. Deals in the €50-500m range enjoyed a nice uptick last year: the €2.2bn worth of transactions in this segment trumped the €883m recorded in 2010, and came close to matching 2009 levels.

Notable mid-cap deals included the €428m buyout of Emitel by Montagu Private Equity as well as the €370m SBO of Zabka Polska by Mid Europa, which both took place in March 2011.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds