Funds

Dry powder will drive 2012 dealflow - Bain

Extensive dry powder, few exit opportunities and tough fundraising conditions will be the major drivers of private equity globally, according to Bain & Company.

AnaCap credit fund hits £350m hard-cap

AnaCap Financial Partners has closed Credit Opportunities Fund II on its ТЃ350m hard-cap.

Video: EU regulation's impact on CEE-focused funds

IPES commercial director Justin Partington talks to Greg Gille about the current challenges facing CEE-focused private equity funds.

Governments' contribution to VC up six-fold

Government agencies and corporates are increasingly active in venture – but they should push further in support of European VC, argues Olivier Marty

Caixa Capital Risc raises third fund

Caixa Capital Risc has raised its third fund, according to reports in the Spanish press.

123Venture launches €100m mezzanine fund

123Venture has launched a new mezzanine fund, Trocadero Capital & Transmission II, with a €100m target.

Belgian, Chinese sovereign funds to launch joint vehicle

China Investment Corporation (CIC) is launching a small fund to help domestic companies make investments in Europe in partnership with Belgian Federal Holding Company and A Capital.

Montefiore targets €180m for third fund

French mid-cap player Montefiore Investment has launched its third fund, Montefiore Investment III, and is looking to raise €180m.

Connect Ventures holds €16m first close

Newcomer Connect Ventures has held a тЌ16m first close for its maiden early-stage fund.

ISIS closes fifth fund on £360m

ISIS Equity Partners has closed its fifth vehicle ISIS V on ТЃ360m.

Idinvest launches mezzanine fund

Mid-market European private equity firm Idinvest Partners has launched the Idinvest Private Value Europe fund.

Innovacom seed fund Technocom 2 closes on €30m

Seed fund Technocom 2 has held a final close on €30m, after receiving a €18.7m commitment from Fonds National d'Amorçage (FNA).

ISIS to close latest fund on £350m

ISIS Equity Partners is about to announce the close of its fifth fund on ТЃ350m, according to reports.

Notion Capital holds a $100m first close

Notion Capital has announced a $100m first close for Notion Capital Fund 2, its second fund focused on emerging cloud computing and software-as-a-service (SaaS) companies in the UK and Europe.

WestBridge closes £30m SME fund

WestBridge Capital has closed the WestBridge SME Fund on its ТЃ30m target after two years of fundraising.

Investindustrial nears €1.25bn hard cap

Southern European GP Investindustrial is in the final stretch of raising its fifth fund, with more than €1bn in commitments already. Kimberly Romaine reports

Morgan Stanley AIP raises $1.3bn

Morgan Stanley Alternative Investment Partners has secured a total of $1.3bn in commitments for two of its funds.

Equistone fund holds fourth close on €1bn

Equistone Partners Europe Fund IV has held a fourth close on approximately €1bn.

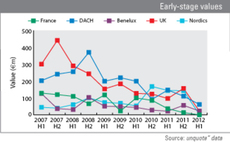

Declining activity belies venture successes

Although European venture capital activity decreased by 12% to €974m last year, 2011 saw a number of sizeable fund closes as well strong exits, indicating fresh appetite for the asset class.

CIC Mezzanine holds €63m first close

CIC Mezzanine Gestion has held a €63m first close on its third mezzanine fund, three months after launch.

Searchlight Capital closes first fund at $860m

Searchlight Capital Partners has closed its first fund at $860m.

French asset manager launches PE unit

Meeschaert Capital Partners, focusing on growth capital and small- and mid-cap buyouts, has been established by French asset management group Meeschaert Gestion Privée.

Big Society Capital launches

Prime Minister David Cameron will announce the launch of Big Society Capital in a speech later today.

Earlybird closes fourth fund on $100m

Earlybird Venture Capital has held the first close of its fourth venture fund on $100m.