Funds

EdRIP raises €125m for fourth life sciences fund

Edmond de Rothschild Investment Partners (EdRIP) has held a first close for its BioDiscovery 4 fund on €125m.

Advent Life Sciences gets re-up for latest fund

Advent Life Sciences Fund I, a 2010 vintage venture vehicle managed by Advent Venture Partners, was reopened to accept a new commitment as well as increased investments from existing LPs.

EQT raises €1bn for infrastructure fund

EQT has raised more than тЌ1bn for its second infrastructure fund, reports suggest.

Latest DBAG fund holds €451m first close

Deutsche Beteiligungs AG has held a first close on €451m for its mid-market buyout fund DBAG Fund VI, two months after sending out PPMs.

BlackRock buys Swiss Re private equity unit

BlackRock has acquired Swiss Re Private Equity Partners, which currently has around $7.5bn of assets under management.

ECM closes fourth fund on €230m

ECM Equity Capital Management has announced the final close of its fourth fund, GEP IV, on €230m.

Procuritas closes fifth fund on €200m

Procuritas has closed its fifth investment vehicle on тЌ200m.

Braemar Energy Ventures closes third fund at $300m

Braemar Energy Ventures has closed its oversubscribed third fund on $300m.

Index Ventures closes €350m tech fund

Index Ventures has raised a €350m fund aimed at early-stage investments in the technology sector, Early Stage Fund - IV6.

AXA Private Equity raises $8bn for funds-of-funds

Axa Private Equity has secured $7.1bn for its secondaries fund-of-funds and $900m for its primary investment fund-of-funds.

17Capital nears final close on latest fund

Preferred equity provider 17Capital is understood to have raised around 80% of its second vehicle.

First close for ISAI's second FCPR fund

French venture capital firm ISAI has held a first close for its second FCPR vehicle, ISAI Expansion, on €30m.

FIG launches VC fund for graduates

London-based venture capital firm Find Invest Grow (FIG) has launched its maiden vehicle, the FIG Concept Seed Fund.

Listed private equity recovery underway

Listed private equity

The Nordic coming-of-age

The Nordic coming-of-age

Siparex closes MidCap II fund on €130m

Siparex has held a €130m final close for the Siparex MidCap II vehicle.

Synergo to launch Turkish fund

Italian private equity house Synergo has signed an agreement with the Baykam family, founders of Turkish private equity firm Baykam Capital Partners, to launch a fund focused on investment in Turkish SMEs.

Triago's Dréan launches online PE marketplace Palico

Palico, a global online marketplace for the private equity fund community, launched yesterday.

Advent exits Vitrue to Oracle

Advent Venture Partners has exited US portfolio company Vitrue in a trade sale to IT solutions developer Oracle, following a 15-month holding period.

Vista Equity Partners closes fourth fund on $3.5bn

American GP Vista Equity Partners has held a $3.5bn final close for VEP Fund IV.

Finnish Industry Investment commits €7.5m to Creandum III

Finnish Industry Investment has made a тЌ7.5m commitment to Creandumтs latest venture capital fund.

EDF sponsors new cleantech VC fund

French energy company EDF has partnered with private equity house Idinvest Partners to launch cleantech venture capital fund Electranova Capital.

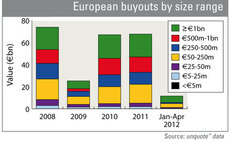

Buyout market could see worst year since 2009

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

Buyout market could see worst year since 2009

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.