Fundraising

GP Profile: Greenpeak Partners on emerging manager fundraising and specialisation

Buy-and-build specialist looks for portfolio add-ons as it contemplates hitting the road for a new fund in 2023

GP Profile: MCP steps up DACH and international focus ahead of next fundraise

ESG and continued expansion of its international LP base also on the agenda, managing partner Inna Gehrt tells Unquote

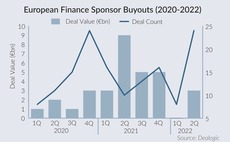

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

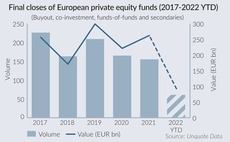

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Final closes down by almost half so far this year, but a number of "mega-cap" vehicles in coming months could still bolster 2022 fundraising

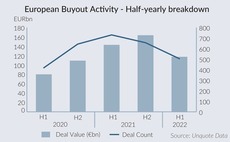

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Record number of LPs to cut "new money" commitments – Rede Partners

Biannual LP sentiment survey also reveals that LPs are expecting a drop in distributions

Alto preps new vehicle as Fund IV deployment nears completion

Italian investor is preparing for new fund investing in Italian SMEs specialising in consumer, industrial, services and pharma sectors.

Main Capital on the road for debut growth fund with more fundraises in sight

New vintage of existing strategies and a healthcare-focused continuation fund are also on the agenda for the software-focused GP, according to founding partner and CEO Charly Zwemstra

PE capital calls at 10-year low in 2021– Investec

Research cited the prevalence of fund financing and the increasing size of funds as reasons for the slow-down

Revaia aims for EUR 400m - EUR 500m final close for Fund II by year-end

VC firmтs second fund is expected to be up to double the size of its EUR 250m debut vehicle

B4 Investimenti on track for new fund launch in late 2023

Italian GP plans to hit the road for Fund III after the end of its current vehicle’s investment period

DBAG to target EUR 1.3bn-EUR 1.5bn for new buyout fund next year

German GP’s new vehicle will be slightly larger than its predecessor, which is set to complete deployment in two years

Alcedo heads for June final close for Fund V

Italian GP has received EUR 230m in commitments to date for Fund V against a EUR 250m hard-cap

Eurazeo heads for EUR 1bn H1 2022 close for PME IV

GP also said in its Q1 2022 results that it has EUR 4.7bn in dry powder across its strategies

EMZ in final stretch of EUR 1.2bn EMZ 10 fundraise

EMZ 10 held a first close in excess of EUR 800m earlier in May and continues to seek new LPs

Equistone files seventh buyout fund

Equistone VI was 61% deployed as of December 2021 and has made 26 investments to date against the 25-30 deals it can make

LongeVC mulls 2023 fundraise for second fund

Biotech-focused VC could hit the road for new USD 180m-200m vehicle once Fund I’s hard-cap is reached

Naxicap preps for Fund III with eyes set on DACH, Benelux expansion

Sponsor expected to hit the road “soon” for its new EUR 1bn-plus small mid-cap buyout fund

Eurazeo gears up for Eurazeo Capital V

GP has registered the fund almost three years after the EUR 2.5bn final close of its predecessor

Elkstone Partners holds EUR 75m first close for start-up fund

Vehicle aims to reach EUR 100m hard-cap by November and will back up to 35 companies

Stirling Square gears up for fifth fund

Fund registration comes just over two years after the EUR 950m final close of Stirling Square IV

Western Balkans PE Fund gears up for debut vehicle first close

With a EUR 15m- EUR 20m close set for October, new SME-focused fund will now look to attract institutional investors from across Europe

EQT sets Fund X hard-cap at EUR 21.5bn

GP is also on the road for funds including its EUR 4bn, impact-focused EQT Future Fund

European PE fundraising forges ahead amidst macro uncertainty

Unquote explores LP preferences, GP behaviour and the challenges ahead in what many expect to be a record fundraising year