PE fundraising pipeline offers hope amidst slowdown in H1 2022

Amidst a crowded fundraising market and a tough macroeconomic environment, final closes of private equity funds in Europe to date in 2022 have struggled to keep up with the same period in 2021. However, a number of large-cap vehicles in the pipeline indicate that the market is still in for a robust year of fundraising.

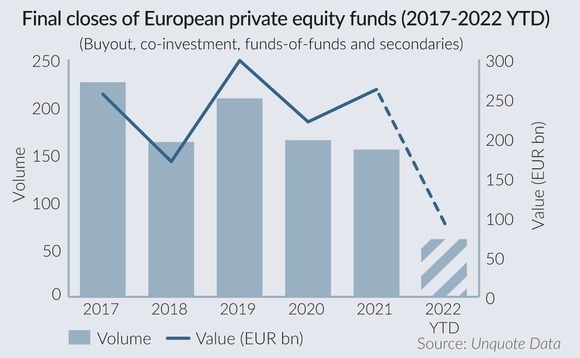

According to Unquote Data, European PE firms have raised EUR 92bn across 61 final closes to date in 2022, versus 95 final closes totalling EUR 175.5bn from January to July 2021. This means that 2022's fundraising is down 47% on the same period in the previous year in terms of aggregate value, with the number of final closes down by more than a third.

The large amount of capital raised in 2021 was down in part to pent-up demand from delayed fundraises over the course of the worst of the coronavirus pandemic, as well as an increasingly short deployment period as sponsors sought to take advantage of favourable market conditions.

A low fundraising tally for the year to date, amidst what many LPs have told Unquote is an exceptionally busy year for them, might seem contradictory. However, this busy year coincides with a period where it will be harder to push final closes over the line, as reported. The sheer number of GPs in the market (some with multiple strategies at once) has meant that much of LPs' time has been taken up with re-ups, which have also been heavily constrained due to the number of managers in the market, meaning that some funds may have to stay open until 2023 to secure next year's re-ups.

The fruition of these heavy workloads may be still to come in H2 2022, with a number of "mega-cap" fundraises lined up. Apollo Investment Fund X was expected to hit the market in H1 2022 with a USD 25bn target, according to Unquote Data. Blackstone Capital Partners IX was registered in December 2021 and could target up to USD 30bn, according to Unquote Data.

A number of GPs targeting EUR 5bn-plus vehicles are also still on the road, according to Unquote Data. KKR is targeting EUR 6bn for its sixth European fund; Cinven is on the road for its eighth flagship fund with a USD 12bn target; while Nordic Capital is on the road for its 11th flagship fund, which held a EUR 7.9bn first close in May 2022, according to Unquote Data.

These large-fundraises are likely to continue the trend of increasing average fund sizes seen over the past few years as GPs steadily (and, in some cases, rapidly) raise increasing amounts per fund vintage. The average fund size to date in 2022 was EUR 1.5bn, marking a 15% increase on the average fund size recorded in 2017, according to Unquote Data.

GPs fundraising in 2022 are undoubtedly facing a tougher market than those who raised funds in 2021, with several GPs telling Unquote that they consider this the "toughest ever" market in which to raise a fund. To get their funds over the line, a number of mechanisms remain open, be it keeping funds open for longer to onboard LPs constrained by re-ups, or positioning their fund terms in a way that is appealing to LPs.

Placement agent Rede Partners' latest Rede Liquidity Index reflected LPs' caution this year, with a record number cutting "new money" commitments and a broad expectation that distributions will fall this year amidst a tough exit environment, as reported. Much like in private equity deal-making, due diligence and a clear and differentiated approach will be key to securing commitments from LPs.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds