Investments

Thyssenkrupp Elevator consortium seeks additional equity investors – report

Advent, Cinven and RAG Stiftung agreed to buy the company in February in a deal valued at €17.2bn

Tech, IT and software valuations remain stable – survey

Report from GCA Altium tracks the effect of the coronavirus crisis on listed technology companies

Adcuram-backed Poggenpohl files for insolvency

Kitchen furnishings retailer plans to continue its restructuring and will seek new investment

German GPs weigh up portfolio damage and rescue packages

Nature of Germany's industrials-weighted economy has caused problems for some GPs when it comes to liquidity needs

UK small-cap GPs look to build on growth amid Covid-19 turmoil

How pricing in the smaller PE segment will be affected by the coronavirus crisis is not yet clear

KKR expects lower valuations for its portfolios due to Covid-19

GP forecasts that emergency restrictions will challenge its ability to market new funds and strategies

EC launches €300m platform Escalar

In its pilot phase, Escalar will provide up to тЌ300m, backed by the European Fund for Strategic Investments

Delays in cross-border carve-outs add hefty surcharge – report

An average 16% of deal value drains away when processes over-run for more than four months, according to a recent TMF report

European consumer M&A presents opportunities in Covid-19 chaos

Europe's consumer sector offers pockets of opportunity as the coronavirus pandemic wreaks havoc on M&A

VCs ramp up coronavirus mitigation efforts

Partners from Balderton, General Atlantic, Anthemis Partners, TCV and Speedinvest dicuss the crisis

Q&A: Cambridge Associates' Featherby on PE's time to shine

Very few managers will have net benefited from this crisis, says Featherby, but PE could still showcase its ability to outperform

BVCA proposes £500m early-stage funding facility

Submission proposes a bridge funding facility in the form of a convertible loan of up to ТЃ5m per company

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Unquote Private Equity Podcast: Covid-19 special

The team gathers for its first remote podcast, discussing how the early stages of the outbreak have disrupted the European PE landscape

Tech, business services power through amid Covid-19 rout

Of the 53 deals seen in March, 28 came from technology and business services

Turnaround funds eye European companies hit by Covid-19

Turnaround players have raised at least $5bn overall in Europe in recent years

PE examines portfolio liquidity options as coronavirus halts dealflow

Managing financial and liquidity risk is front of mind as managers fret over the potential impact of a severe downturn

Nordic buyout market has silver linings, despite low volume

Nordic region sees the lowest quarterly deal volume since Q4 2013, with just 17 buyouts in Q1 2020

UK holiday parks advised to close: Portfolios affected

British Holiday and Home Parks Association has advised its members to close all holiday parks

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Annual Buyout Review: European momentum likely to be hit hard

Unquote's lastest Annual Buyout Review is now available to download, offering in-depth statistical analysis of European buyout activity in 2019

Italy embarks on the "deep tech" revolution

"Deep tech" startups specialise in transformative technologies, such as nanotechnology, industrial biotech, and advanced materials

UK industry welcomes rescue package, but concerns remain

Package includes ТЃ330bn in loans, ТЃ20bn in other aid and a postponement of business rates

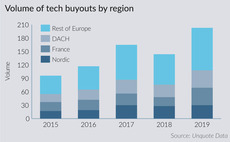

Technology buyouts stall in Nordic region

Technology buyouts have hovered around the 30-per-year mark for three years running now, suggesting a plateau has been reached