Investments

LDC's makes 18 investments in H1 2020

In a half-year update, the firm announced the majority of the deals were completed since March

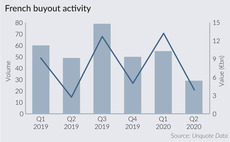

Lockdown impact derails French buyout momentum

Even as France is now moving on, the uncertain road ahead is threatening to undo months of improving activity and market sentiment

M&A wave incoming in 2021, says Edmond de Rothschild CIO

Investment bank's H2 2020 outlook also emphasises continuing macroeconomic uncertainty, and singles out healthcare and data assets as winners

Buy-and-build: 3i's five-step strategy

Pete Wilson, partner and head of UK private equity at 3i, outlines some key considerations for executing successful bolt-on acquisitions

Nordic e-commerce confident "silver krona" uplift will persevere

Lockdowns have т out of necessity т introduced a new age group to online shopping, boosting prospects for several PE-backed assets

Italian PE: an opportunity in crisis

The latest edition of Gatti Pavesi Bianchi's series on the Italian private equity and M&A markets is now available to download

Buy-and-building through the storm

Bolt-ons remain one way of deploying capital and building value, but a tough financing market and pricing mismatches make for a challenging landscape

From PE darling to hard-hit sector: gyms face uncertain post-covid future

As gyms and fitness clubs across Europe gear up to welcome back consumers, Unquote explores their tricky path out of lockdown

Bain Capital, FSI to bid for Serie A – report

Bain Capital makes a €3.4bn preliminary offer for a 25% stake in Serie A, while FSI shows interest

Nordic GPs find solace in demand for tech deals

Buyout activity in the Nordic region has nose-dived in 2020, while venture capital activity surged in some countries

Impact investing: LP perspectives

Three European LPs discuss how they define impact, their favoured measurement metrics, and the kinds of managers they look for

Q&A: Pemberton's UK head Eric Capp on direct lending's future

Private debt professional Eric Capp discusses his long-term view of the direct lending landscape

KKR commits $1bn for GTR formation

Investment will be supported by $1.5bn in debt financing for a buy-and-build startegy

DACH PE looks to mid-term effects as lockdowns ease

Local players do not anticipate a sudden return to action just because lockdowns are eased

Impact Investing Report 2020

Unquote has now released its inaugural Impact Investing Report, published in association with the Aztec Group

Impact investing webinar: Capital Meets Conscience

Watch a virtual event on impact investing, with panellists including Bridges' Maggie Loo and Daniela Barone-Soares from Snowball

Maguar Capital in exclusive talks to buy HR Works – report

Newly established Germany-based GP focuses on software investments, according to Mergermarket

Video: OTPP's Topley discusses liquidity squeeze, GP discipline

Joe Topley, head of European funds at Ontario Teachers' Pension Plan, shares his LP perspective on the current state of the private equity market

Dutch court orders Nordian to proceed with J-Club acquisition

Court documents show that the company has an EV of €100m and the GP was seeking financing of €40-45m

Unquote Private Equity Podcast: Belt & braces

Rowan Bamford and Gareth Rees from Liberty GTS examine the impact of Covid-19 on W&I insurance, and share their take on where the M&A market is headed

Travel sector assets: Seeking solutions to long-lasting woes

Unquote explores the challenges ahead, how PE-backed companies are adapting their business models, and how they can bounce back

Q1 Barometer: Year of sustained growth finally halted in Q1

The European private equity market cooled in Q1, even before the Covid-19 crisis took hold, after an especially active Q4 2019

Weber family in asset deal for Ardian-backed Weber Automotive

Shareholder structure is unchanged and the automotive supplier's self administration continues

2010-vintage funds: what is still in UK portfolios

PE managers now have a number of options available to them when funds near the end of their lifespan