Investments

Acuris coronavirus impact analysis

Assessing the early impact of coronavirus on capital markets and sectors

Coronavirus outbreak leaves Italian PE industry in limbo

With Italy being the worst-affected European country, deals and fundraising are so far confined to a timeless limbo

KKR, Henkel in final bid for Coty nail and hair – report

Advent and a consortium of Cinven and the Abu Dhabi Investment Authority reportedly left the process

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Private equity seeks solutions to uncertainty as coronavirus derails buyouts

Dealmakers are trying to keep the buyout show on the road as the coronavirus crisis overtakes the European market

Coronavirus outbreak could lead to fundraising logjam, PE players warn

Industry participants contacted by Unquote expect negative ramifications for fundraising as well as deal-making activity

Failed auctions accelerate as sellers' market peaks – research

UK accounts for 54% of failed auctions since 2015, according to the Investec research

NIBC board supports Blackstone takeover offer

JC Flowers and Reggeborgh are majority shareholders in the listed Netherlands-based bank

2020 Outlook: Southern Europe finishes 2010s on record high

Deal volume was the highest on record in 2019 with 174 buyouts, though aggregate value decreased to €25bn from €30bn

Bain-backed Fintyre Germany for sale in insolvency proceedings

Tyre retail group is up for sale with PwC advising, following the insolvency of several subsidiaries

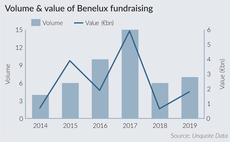

2020 Outlook: Benelux dealflow breaks records as fundraising recovers

While often out of the European private equity limelight on the deal-making side, the Benelux region quietly posted an excellent 2019

Reiff Reifen files for insolvency

Bain's tyre wholesale and retail group European Fintyre Distribution bought the company in 2017

Q4 Barometer: Continued buyout bonanza tops record-breaking year

Private equity investors completed 807 deals in Q4 2019, tipping the year into record-breaking territory

2020 Outlook: DACH buyout volume stalls amid macro uncertainty

Overall dealflow plateaued, with just one buyout more recorded in 2019 compared with 2018

2020 Outlook: Tech deals boom while fundraising flourishes in France

Local GPs look forward to another busy year and hope to build on the record dealflow seen in 2019

Unquote Private Equity Podcast: IPEM Highlights

The Unquote Private Equity Podcast recaps key takeaways from exclusive interviews with a number of speakers and delegates

2020 Outlook: Political change heralds UK buyout revival

Deal volume was down last year, but record-high value and a more settled political backdrop mean 2020 could be busy for the UK

Unquote Private Equity Podcast: the Review/Preview special

In this special bumper episode, the Unquote editorial team does a deep dive on key 2019 stats in each market

Corporate divestments fuel European buyouts

Carve-outs and spin-outs represented around 14% of all buyouts in 2019, up from 11.5% in 2018 and 10% in 2017, according to Unquote Data

Unquote Private Equity Podcast: Craving carve-outs

Listen to the latest episode of the Unquote Private Equity Podcast, where the team discusses corporate carve-outs

Swiss and German venture peaks in Q3 2019

Aggregate value of venture deals in Germany soared to more than €2.73bn across 85 deals

Italian PE: Strength in numbers

First three quarters shaped up well in terms of volume, with total deal numbers marginally higher than those for the same period in 2018

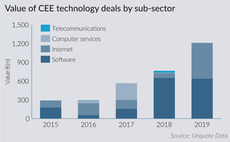

Software sector lures increasing amounts of capital in CEE

Interest in the software sector in CEE is on the up and was especially prominent in Q3

Minority investing gains traction in southern Europe

Abundance of dry powder and expected downturn have pushed GPs towards experimenting with more diversified ways of deploying capital