Investments

Unquote Private Equity Podcast: Taking stock

Listen to the latest episode of the Unquote Private Equity Podcast, dedicated to the resurgence of take-privates

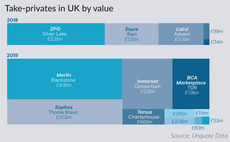

UK-focused GPs getting creative with buyout sourcing

In 2019, 10 take-privates have been agreed in the UK and Ireland to date, up from five in 2018

European biotech flourishes as US and Asian capital pours in

Attracted by a buoyant industry with a rich pipeline, numerous US and Asian players have entered the market

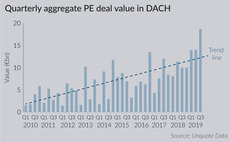

DACH activity skyrockets in Q3 despite looming recession

Aggregate value in DACH for Q3 reached its second highest level at €18.7bn

Rutland Partners on empowering management

Rutland explains how management teams are at the core of its value-creation strategy

Team spirit: the enduring appeal of co-investment

This year, тЌ7.87bn was collected across seven co-investments funds, breaking Unquote Data records

Q3 Barometer: deal volume hits new record with mid-market push

Buyout market has been strengthening consistently and was only four deals away from hitting 300 in the third quarter

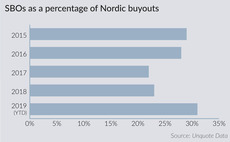

"Pass-the-parcel" deals surge in Nordic region as PE matures

At nearly a third of all buyouts, the proportion of SBOs is now higher in the Nordic region than it is across Europe as a whole

UK General Election: reactions from the PE community

Private equity players and advisers speak on the potential for the resolution of Brexit and the effect it may have on deal activity

Benelux biotech and pharma startups attracting larger rounds

Average tickets for early-stage investments have jumped from €13m in 2017, to €20m the year after and €36m this year

Unquote Private Equity Podcast: Co-op mode

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team talks all things co-investment

UK late-stage venture boom offsets early-stage lull

Second quarter saw an average value per deal of ТЃ30.7m, significantly higher than the 10-year average of ТЃ11.8m

Looking for the digital health tonic

Massive recent uptick in investment means 2019 is expected to reach an all-time high for digital health

International funds dive into southern Europe's education sector

Education institutions and online universities are flourishing in southern Europe, attracting international GPs

Treasure hunt: striking the right origination mix

Unquote explores technology-led advances and the evolution of the more traditional models

Take-privates thrive amid growing pressure to invest

Public-to-private deals are back in fashion, with a record number of transactions

Resilient Romania attracting PE

PE investment across all brackets has picked up in Romania this year, and CEE stalwart Mid Europa has just opened an office in the country

Danish pension funds set out green investment ambitions

Danish pension funds are set to commit DKK 350bn ($50bn) to green investments

H1 Review: Deal volume steady in southern Europe; value drops

Region recorded 70 buyouts worth an aggregate value of €11.2bn in the first six months of the year

H1 Review: Nordic pricing frothy as cross-border capital pours in

Nordic region retained its position as the most expensive place in Europe for private equity firms to buy companies in Q2 2019

Unquote Private Equity Podcast: Cloudy with a chance of slowdown

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses H1 stats and looks ahead

H1 Review: Fundraising and local capital herald CEE buyout revival

Baltic market stands out, recording a higher than usual share of the wider region's dealflow

H1 Review: Large-cap value drives Benelux buyout activity

H1's aggregate value of €11.1bn resulted in a 60% increase on H2 2018, and reveals large-cap activity remains strong in the region

Buying and building the modern school

Investments in European private schools and colleges have proven enriching for PE over the past two decades