French buyout value climbs to post-crisis peak

French buyouts reached a post-crisis peak in terms of aggregate value in 2018, comfortably surpassing 2017's figure. Francesca Veronesi reports on competition within the region, high prices, availability of debt and political unrest

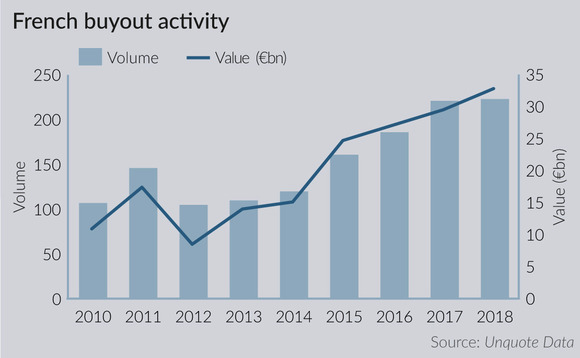

With an aggregate value of €32.8bn invested in 223 buyouts, the French private equity market flexed its muscles in 2018. Last year decisively surpassed 2017's total value of €29.5bn and edged above its deal count of 221, according to Unquote Data. More remarkably still, 2018's figures are the highest seen in the country since the pre-crisis years.

The increase in overall value was largely driven by large-cap transactions: there were 17 deals valued at more than €500m for a total value of €18.2bn, exceeding 2017's €15.5bn across 12 deals. The mid-market, by comparison, saw 134 deals totalling €13.5bn, similar to the levels seen in 2017 when there were 121 deals in the €25-500m price range for an aggregate €12.6bn. There was a slight year-on-year dip in volume and value in the sub-€25m range (69 totalling €1.1bn, compared with 88 totalling €1.3bn).

Asked whether political instability in France has had any tangible effect on the private equity market, Omnes managing director Benjamin Arm says: "The gilets jaunes movement has not affected French and European LPs' views on the market. Rather, it has negatively impacted some B2C portfolio businesses of GPs, for which Q4 last year was crucial in terms of revenues. In fact, the macroeconomic event that is being most discussed with LPs is actually Brexit. As the French private equity market is the most developed on the continent, it is undoubtedly benefiting from a diversion of capital that would have been allocated to the UK, if it was not for Brexit."

Indeed, in terms of both deal value and volume, France last year outperformed the UK – typically Europe's most active private equity market. While the difference in volume was nominal, aggregate value was €2.7bn higher, marking only the third time that France's total has exceeded the UK's, having previously done so in 2016 and 2006, according to Unquote Data.

Commenting on the mid-market, Omnes's Arm says: "Competition naturally remains very tough, so in some cases very high multiples are paid and generous management packages provided. With prices so high and a great availability of debt, it will be hard to not commit mistakes and some players in the market will inevitably have issues whenever the next downturn will take place."

Debt on demand

Alantra managing partner and CEO Franck Portais says the availability of debt led to several dual-track auctions in 2018, where trade buyers struggled to bid as high as GPs. "The phenomenon has characterised the French market for a few years," he says. "In fact, trade buyers cannot offer leverage that is higher than what they have themselves. Strategic buyers offer 3-4x EBITDA debt arrangements, but private equity can do 1-2x more than that, sometimes even 3x more."

Nevertheless, Portais says there is an understanding within the industry that the current environment of low interest rates and a strong economy cannot last forever: "We are seeing some more distressed deals than in previous years, especially in the consumer and construction sectors. Equally, advisory firms are hiring distressed M&A professionals."

The French private equity market is undoubtedly benefiting from a diversion of capital that would have been allocated to the UK, if it was not for Brexit" – Benjamin Arm, Omnes

While not explicitly predicting a downturn, Omnes's Arm stresses that it is not possible to know what the economic environment will look like within the next three to four years. "GPs generally should operate with prudence, investing in non-cyclical businesses and leveraging deals reasonably," he says. "Our impression is that H2 2018 saw a slight normalisation in terms of excesses that characterised 2017 and H1 2018."

Despite these calls for caution, 2018 was another strong year in fundraising terms for the country. There were 16 final closes of buyout funds with a total of €7.8bn in commitments, against the previous year's 17 funds raising €7bn. The total value of commitments was the second highest figure on record, falling 21% shy of the €9.9bn collected over 12 funds in 2016. The region's largest fundraising effort was by PAI Partners, which closed its €5bn PAI Europe VII fund in France's largest buyout fundraise in the post-crisis era, according to Unquote Data.

Politically, last year will be remembered for the surfacing of deeply rooted societal dissatisfaction in France. Developments in 2019 will reveal both the ability of the political class to address these new challenges and the extent to which the country can capitalise on the Brexit impasse.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds