Investments

Wellington eyes late-stage growth opportunities with new USD 2.6bn fund

GP seeks to address capital needs pre-IPO or sale and anticipates a diverse portfolio for fourth fund

Many-headed Hydra: Private markets manager consolidation rears its head

Multi-asset managers set to roll-up credit, infrastructure and secondaries players to add strategies for scale

Unquote Private Equity Podcast: PE perspectives from Berlin

Unquoteтs Min Ho and Rachel Lewis digest the key takeaways from this yearтs SupeReturn

EU Foreign Subsidies rules hold specific challenges for PE

Sovereign wealth funds and pension funds commitments may trigger EC attention under new EU foreign subsidies regulation

Synova sells minority stake to Bonaccord

Passive minority GP stake deal sees Synova join UK peers including MML and Inflexion in taking on external capital

Cariano sponsor Atena Equity Partners sells business and preps new fund

Atena III will invest in complex buyouts, particularly distressed assets and succession issues

GP Profile: Bregal Milestone explores generative AI opportunities for portfolio companies

Plans seven further deals from recently closed EUR 770m fund

European LPs bullish on 2024 PE fund vintages – Coller Capital

LPs remain positive on PE but are considering increasing infra and private credit allocations, latest survey shows

From slash-and-burn to grow-and-earn: private equity changes tack

Rising cost of capital means value-creation will be vital for next decade of private equity, SuperReturn participants said

Unquote Private Equity Podcast: In conversation with... Fabio Ranghino, Ambienta

In an interview with Unquote, Ranghino discusses topics including ESG and the next phase of Ambienta’s growth

Mimir Group ramps up global origination effort with London office and focus on life science carve-outs

Stockholm-based investor is considering divestments, although challenging market remains a barrier

Q1 Barometer: Signs of a brighter future after dark times for European PE

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

LP Profile: Lennertz & Co gears up for new tech impact venture fund-of-funds

German family office’s new strategy is set to launch this year with a EUR 50m-EUR 100m target

Women in PE: Innova Capital's Pasecka on consolidation and succession opportunities amid macro challenges

Magdalena Pasecka discusses the Polish GP’s fundraising and deployment plans, as well as advice for emerging leaders in the industry

European VCs need to match actions to words by increasing funding to female-led companies

Women-led startups usually receive less than 2% of VC capital, but more diverse, defensible female-founded businesses emerging

Eurazeo halves deployment and PE fundraising in Q1 amid 'complex and uncertain' environment

GP has EUR 7.7bn dry powder across its strategies and remains assured of its potential to make exits in H2 2023

CEIP eyes industrials and services targets with EUR 70m vehicle, aims for year-end fund close

Czech Republic-headquartered GP is open to co-investments from LPs and fellow sponsors; one further deal expected this year

Pantheon bullish on consolidation opportunities with fresh USD 2.4bn co-investment vehicle

Taking a cautious approach to valuation expectations, the sponsor is deploying its latest fund across small-, mid-cap and growth opportunities

Gimv acquires majority stake in Witec

Belgium-based Gimv set to support Netherlands-headquartered contract design manufacturer’s growth

Newly launched Utopia Capital aims to deploy EUR 10m-plus by 2028

Angel investor Christian Schroeder's new investment vehicle will support early-stage tech companies addressing humanitarian issues

Podcast: Q1 2023 - Bank runs, fund home runs and markets come undone

Unquoteтs reporting team discuss themes that have arisen in Q1 2023, ranging from liquidity management to venture and growth activity

GP Profile: Aurelius goes global with US expansion as it eyes new EUR 800m fund

German carve-out specialist is 18-24 months away from fundraising for its Fund V with EUR 750-EUR 800m target

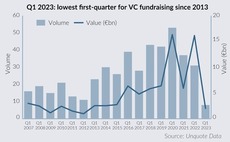

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

Hunter Point buys minority stake in Coller Capital

Proceeds from the deal will be invested into secondaries investor Coller Capitalтs funds