Investments

DACH investors turn to value creation to justify high multiples

Three of the five most active private equity firms based in the DACH region last year used non-standard investment models

Co-investment: Dancing to a new tune

Co-investment has evolved from a value-add into an industry staple, but debate remains as to whether the strategy favours LPs and GPs equally

VC fuels Europe's journey towards self-driving future

Despite the long-term nature of investing in autonomous vehicles and high barriers to entry, fund managers are finding routes into the segment

Video: Mandarin's Inna Gehrt on DACH opportunities

Inna Gehrt, partner and head of DACH at Mandarin, explores why the region is viewed as an LP magnet

Video: Triton's Marcus Brans on operational expertise

Triton's Marcus Brans discusses the most important way that investors can add value to companies

PE-backed UK IPOs outperform, but listings remain slow

Despite a strong track record, PE-backed listings have been few and far between in 2018, but signs of an increase in activity are emerging

LP competition heats up for stakes in GP management companies

One in six LPs is taking stakes in GP management companies via specialist funds

Dutch VC activity reaches all-time high

Biotech and pharma are driving record levels of VC investment in the Netherlands, while venture fundraising continues to perform strongly

Payments sector heats up across the Nordic region

PayPal's $2.2bn acquisition of VC-backed iZettle highlights the Nordic region's leading position in the payments tech market

Italian PE enjoys vibrant Q1 despite political uncertainty

Buyout and exit activity in the country ballooned in the first quarter of 2018, despite the prolonged uncertainty surrounding the general election

Alliance of equals: PE's evolving buy-and-build approach

Portfolio companies are increasingly making larger bolt-ons, as GPs look for new ways to boost returns in a market with high entry multiples

Local GPs rule the roost in Turkish mid-market

International investors struggle to gain a foothold in the Turkish mid-market as local networks provide domestic firms with a headstart

Sino-French PE relations move forward

Chinese trade buyers, GPs and LPs are increasingly active in the French market as the number of funds with Sino-French strategies increases

Mid-market leverage continues upward creep

High price tags, limited assets and cheap debt are helping to push up leverage boundaries in the European mid-market once again

Carve-outs return to prominence in Nordic PE

Proportion of Nordic buyouts accounted for by spin-outs rise in Q1 after two years of lower than average activity

PE activity flourishes in Portugal as economy picks up

Companies with strong export focuses and internationalisation strategies are attracting investment from institutional fund managers

UK and Ireland small-cap soars amid general buyout lag

Overall UK buyout activity in Q1 is down by almost a third year-on-year, though dealflow in the small-cap space remains near record levels

CEE exit activity picks up in Q1 as buyouts drop

First quarter saw a significant drop in both buyout volume and aggregate value in the region, though the number of exits is up, year-on-year

Nordic buyout market soars in Q1

Acquisitions in the region reached the highest aggregate value ever recorded in the first quarter of the year

Benelux's biotech and pharma buyouts market in rude health

Buyout houses are becoming more attracted to assets in the Benelux biotech and pharma spaces, typically the preserve of venture capital investors

Consumer uncertainty sees retail feeling the pinch

PE-backed retailers are increasingly following casual dining chains in showing signs of struggling under the downturn in UK consumer confidence

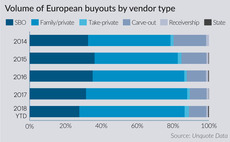

Secondary buyouts hit 10-year low in Q1

Proportion of deals sourced from fellow PE firms has ebbed back to the level last seen in 2007, according to Unquote Data

European entry multiples hit new high in 2017 despite Q4 cooldown

Average EBITDA multiple increased to 10.4x in 2017 compared with 10.2x in 2016, according to the latest Clearwater Multiples Heatmap

Mega-buyout volumes hit post-crisis Q1 high

Combined with Q4 2017, the past six months have represented the most active consecutive quarters for тЌ1bn-plus buyouts since 2007