Investments

Annual Buyout Review: Lower-mid-market momentum lifts dealflow

Unquote's lastest Annual Buyout Review is now available to download for subscribers, offering in-depth statistical analysis of 2017 activity

European LPs hungry for more co-investment, secondaries

Demand for primary deployment was also positive, with 37% of European LPs expecting to do more

Summa's Reynir Indahl on Nordic fundraising, ESG

Ahead of the upcoming Mergermarket Nordic M&A and Private Equity Forum on 15 March in Stockholm, Summa Equity co-founder and managing partner Reynir Indahl talks to Unquote about fundraising, and value creation in ESG strategies in the region

Investindustrial's Valtur files for insolvency

Investindustrial bought Valtur in 2016 in an all-equity deal valued at around €100m

Brait's New Look proposes CVA with closure of 60 stores

High street fashion retailer will look to renegotiate its rental and debt agreements

Italian venture moves upmarket as overall activity dips

Venture dealflow and aggregate value decreased in 2017 following five years of growth, as VCs turned their attention to later-stage rounds

Q&A: Rutland's Craddock on Aston Barclay and making partner

Special situations investor's newly appointed partner discusses the firm's evolution and its recent investment in the UK-based car auction business

Techwald's SPAC Life Care Capital to trade on AIM Italia

SPAC will invest in non-listed medium-sized Italian companies active in the healthcare sector

TPG's Prezzo to close 94 restaurants following CVA

Casual dining chain suffered an 8.1% drop in like-for-like sales in 2017 and owes ТЃ220m to creditors

Deals accelerate in German online marketplaces

Three transactions in the space within the first two months of 2018 saw PE firms invest a combined €500m and cash out more than €700m

Large-cap deals drive strong start to 2018 for European PE

GPs deploy an extra тЌ7bn in aggregate value across European buyouts in the first two months of the year compared to 2017

Casual dining: overbooked and undercooked

British PE owners are facing challenges as the sector shows signs of strain due to oversupply and macroeconomic headwinds

European PE in 2017: Scaling new heights

Buyout activity and fundraising reached a new peak in 2017, with mega-buyouts and small-cap deals fueling dealflow and French funds popular among LPs

CEE mid-market players welcome renewed attention from larger GPs

Focusing on the mid-market pays off, as renewed interest from international sponsors affords interesting SBO opportunities

DACH auto-parts deals motor on as sector transforms

Private equity players remain keen on auto-parts, as the sub-sector responds to rapid changes brought about by the electrical vehicle market

Canadian pension funds make inroads in France

unquote" looks at Canadian institutional investors' renewed appetite for direct investments in large-cap French assets

VCs tread cautiously around blockchain craze

VC activity in cryptocurrency has increased, but despite eye-catching deals, their volume is not as high as the wider enthusiasm would suggest

Partners Group reaches €61.9bn in AUM

Private debt is the fastest growing allocation area for the firm, with new commitments of тЌ3.5bn

European PE in 2018: beware the bullet

unquoteт brings together a group of leading practitioners to analyse industry developments during 2017 and discuss emerging trends heading into 2018

European PE in 2017: fundraising tailwinds and growing leverage

Industry professionals look back on a resilient year for private equity during a period of turbulent geopolitics

Fundraising record rounds off active year for Nordic region

Region saw strong fundraising and high deal volume off the back of low interest rates in 2017

Tech gains traction in French private equity

Expansion deals and small-cap buyouts fuelled a strong 2017, with tech proving increasingly popular among buyout houses

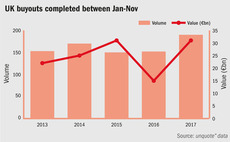

UK buyout activity reaches post-crisis peak in 2017

Small-cap and lower-mid-market invested strongly during the course of the year, while fundraising activity continued apace

Benelux funds specialise to compete with strategic buyers

Record level of commitments were secured by Benelux funds during 2017, with GPs increasingly turning to sector specialisation