Investments

Deal in Focus: Carlyle sells Itconic to Equinix

Sale comes two and a half years after the GP acquired the business and is the first divestment for its third Europe-dedicated fund

Nordic buyers increase dependency on family vendors

H1 saw the number of PE-backed deals sourced from entrepreneurs reaching a three-year high

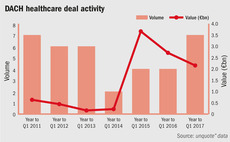

DACH region opening up for PE activity in veterinary space

Local regulations surrounding consolidation in the sector have held back PE investment but EU court rulings could bring opportunities

International backers fuel record-breaking H1 in Spain

Country's dealflow has reached the highest level in value terms ever recorded

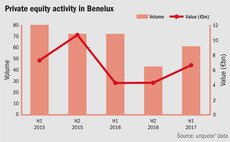

Benelux activity picks up in first half of 2017

Following a slow H2 in 2016, dealflow in the Benelux region is on the up with Belgium in particular seeing increasing activity

Aerospace investments taking off for PE

As evidenced by the recent VistaJet and Pattonair deals, PE is increasingly looking at the aviation and aerospace sectors for opportunities

Corporate caution creating carve-out opportunities for PE

Political instability may trigger a raft of corporate divestments, from which PE could profit

Germany's new foreign investment rules raise challenges for PE

Government's adoption of an amendment giving it increased rights of scrutiny could require increased due diligence for private equity houses

Nordic market awakes from slumber

Trio of large-cap deals in June spark life into region's buyout market with dealflow more than doubling compared to the previous month

UK PE activity rebounds in H1 despite political turmoil

British buyout market witnessed a significant year-on-year increase in activity in the first half of 2017, despite political uncertainty

Deal in Focus: Ufenau reaps 6x on NRW sale

Divestment of building refurbishment company follows a tenure of less than three years

Investor influx drives southern European multiples upwards

Increasing global levels of dry powder are seeing international GPs setting their sights on southern Europe in search for value

Nordic Fundraising Report: dealflow, co-investments and the road ahead

In the final part of the unquote" Nordic Fundraising report, unquote" looks at the wider dealflow, lending and co-investment trends in the region

Average multiples remain stable at 10.2x in Q1

European valuations keep track with 2016, but drop slightly compared to Q4 2016

Deal in Focus: Terra Firma sells Infinis wind assets to JP Morgan

Sale of onshore wind assets follows a protracted 14-year holding period punctuated by numerous partial exits, an IPO and subsequent delisting

Deal in Focus: Starwood, L Catterton exit Baccarat in €164m deal

Starwood has been invested in the crystal glassware maker for 12 years, while L Catterton first backed the company in 2012

PEP, Equita join forces to launch SPAC

Vehicle aims to provide mixed debt-equity instruments to Italian SMEs on a deal-by-deal basis

Fostering growth in Belgium's private equity market

While Belgian private equity activity is traditionally quieter than in the Netherlands, the market still has room to grow

Brexit to boost European corporate carve-out activity, says Aurelius

Special situation investors are likely to be the biggest buyers, survey respondents said

Deal in Focus: Quadriga Capital sells M&R to PIA

Vendor sells its majority stake in the automation business after a holding period of less than two and a half years

Deal in Focus: Eurazeo buys Mondelēz confectionery arm for €157m

Following the deal, the company's international production will be relocated to France

Shot in the arm for DACH healthcare market

Consolidation opportunities in the mid-market fuel increased investment from private equity, with aggregate volume reaching a six-year high

Spain reaps highest value in Q1 since 2005

Spanish private equity firms deployed the highest volume of capital in 12 years during Q1 2017, with €4.7bn deployed

Benelux's packaging firms playing hard to get with PE

Failed take-private efforts by GPs have meant activity in the region has remained dominated by small-cap and lower-mid-market deals