Investments

CEE closes out 2017 with strong investor confidence

Fundraising and deal activity both increased in the region during 2017

Spanish private equity flourishes as Italian market cools

Southern Europe's leading PE markets responded drastically differently to the challenges of a turbulent 2017

US pension fund to commit $325-350m to PE in 2018

Lacers will place special emphasis on mid-market and lower-mid-market buyout funds

University of Calgary hiring PE investment adviser

Investment committee recently approved the inclusion of PE and infrastructure in its portfolio

Deal in Focus: IK buys Studienkreis from Aurelius

IK had considered previous opportunities in the education space, with the firm's partner Petersson saying the sector offers good opportunities for PE

The lure of consumer-focused fintech

European fintech companies are attracting increasingly large investment rounds

Mid-market valuations at highest level ever in latest Argos index

Sharp increase in prices paid by strategic buyers push the median entry multiple to 9.5x

Technology: Europe's magnetic north

Mid-market deals in northern Europe are at the forefront of tech deal activity, with enterprise software and payment tech notable areas of attraction

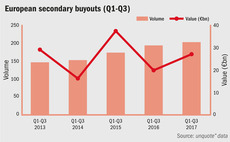

European SBOs reach record levels in first three quarters

Europe sees 202 secondary buyout deals between January and September, surpassing the peak of 200 seen in Q1-Q3 2007

French state arm CDC IC ramps up Mubadala partnership

New co-investment agreement will see CDC International Capital, BPI France and Abu Dhabi's Mubadala deploy an extra €1bn in French businesses

UK tech dealflow resilient despite spectre of Brexit

UK investments accounted for 28% of European tech dealflow in the first three quarters of 2017, with a flurry of fintech deals already seen in Q4

Average entry multiple climbs to 10.8x in Q2

Price inflation has led average European multiples to rise further in Q2, according to the latest unquote" and Clearwater Multiples Heatmap

Q&A: Rutland's Morrill and Wardrop on Millbrook and Pizza Hut

Special situations investor's partner and managing partner discuss the strategies behind the two award-winning investments

Picking a DACH mid-cap master

With so many proponents of the mid-cap space in the region, how do LPs decide on their allocations?

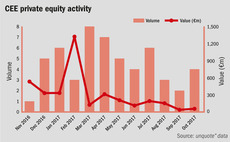

Tech deals return to the CEE region

Tech activity in CEE remains sluggish, though aggregate values are on the increase

Deal in focus: Springwater sells Delion four years after carve-out

Following a challenging investment in the comms industry, the company has been sold back to management

Deal in Focus: Dunedin reaps 55% IRR from Alpha IPO

Divestment of wealth management consultancy came ahead of schedule, generating an ТЃ89.6m return

SPACs offer flotation alternative for Italian GPs

Special purpose acquisition companies are gaining traction in Italy, offering an alternative exit route for GPs

Turkish IPO activity on the rise

Recent flotations could be a sign of what's to come, after the country relaxed its IPO rules

Benelux open for business as trade sales recover

Nine months into 2017, the number of exits to trade buyers exceeds 2016's levels, reflecting healthy European corporate M&A activity

More balanced economy for Norway as tech attracts investors

As the country recovers from the 2014 oil price collapse, former engineers are emerging as entrepreneurs at VC- and GP-backed companies

Artificial intelligence offers smart opportunities for PE

Once the domain of early-stage VC investors, the AI segment is now attracting the attention of private equity buyers

Minority investments brewing in the UK craft beer space

Negative connotations associated with the sale of microbreweries to conglomerates brings opportunities and challenges for PE backers

Q&A: Baker Botts' Neil Foster on corporate venture

Law firm's partner speaks to unquote" about the growing prevalence of corporate VCs in Europe and its ongoing evolution