Investments

Deal in Focus: TSG invests in BrewDog

Scottish brewer's owners have been critical of craft breweries selling to trade buyers, raising questions surrounding the GP's exit strategy

Strong start in CEE for second year running

Region registered 10 deals in Q1 for the second year running, though 2016 saw deal volume halve in H2

Deal in Focus: Bain and Cinven to take Stada private

Acquisition of German pharmaceutical company would be the largest buyout ever recorded in the country

Nordic buyout market off to slow start in 2017

Buyout volume in Q1 was slowest start to a year since 2013, while Q1 exit figures were at their lowest first-quarter level since 2011

French dealflow hit record high in 2016

After years of failing to exceed UK dealflow, the country finally clinched the top spot of the European league table in buyout volume

Insurtech puts a premium on technology

PE and VC players turn their attention to the insurance space as fintech's next scalable disruption opportunity

Steady growth driven by smaller deals in Benelux

The Benelux region recorded a fourth successive increase in buyout volumes, thanks to strong activity in the smaller size brackets

Italy's aggregate value soars in 2016

Despite a slight dip in deal volume, Italy witnessed a 38.3% increase in aggregate value terms in 2016

Short-term consumer boost eases probable Brexit fallout in UK

Inflation, wage stagnation and trade uncertainty threaten the UK and Irish private equity markets post-Brexit

DACH proves its value with highest volume increase rate in 2016

Buyout activity in the DACH region witnessed the highest increase rate in deal volume across Europe in 2016

Iberia continues resurgence despite political drama

Positive macroeconomic outlooks, coupled with plentiful debt and renewed international interest, have nullified the effects of political instability

Aggregate value drops as Nordic assets look to public markets

Private equity firms are battling with stock exchanges for the affection of businesses in search of capital in the Nordic region

Larger deals underpin solid CEE performance

The appearance of larger buyouts drives values up and highlights growing maturity in the region

European entry multiples rise to 10.2x in 2016

CEE, southern Europe and the Nordic region drive average price increase, while UK valuations drop

Deal in Focus: Ardian to take majority stake in Prosol

French hypermarket group reportedly valued in the region of €1bn, with existing investors remaining as minority backers following completion

Dino Polska IPO could revive public exit route for PE in CEE

Public market exit route has been in decline for central and eastern European private equity since its 2013 post-crisis peak

Chinese investors bring exit opportunities but inflate entry prices

Research reveals GPs are noticing an increased appetite from Chinese backers for European assets

GPs and non-execs: Partners through thick and thin

Recent reports have questioned the logic behind appointing NEDs to portfolio companies, though there is little sign of GPs changing their approach

Portugal boosts southern Europe's 2016 resurgence

Recent uptick in the country's buyout activity mirrors similar investor appetite seen five years earlier in Spain

Kima-backed startup Heetch in limbo following court verdict

Ride-sharing app is deemed to be enabling unlicensed taxi operation by its users

Natixis hires two in Milan

Investment bank boosts its coverage and M&A branch in Milan with two senior appointments

UK consumer deals slump as GPs heed Brexit warnings

Strong consumer spending figures in the months following the EU referendum have not translated to increased PE investment in the sector

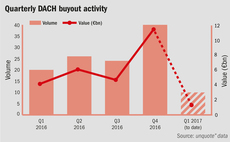

Quiet start to 2017 for DACH buyouts following Q4 flurry

Number of large German deals saw the DACH region outpace its European neighbours at the end of 2016, in terms of aggregate value

DACH GPs hunt for value following fundraising bonanza

With strong fundraising activity in the region, GPs must now find value in a challenging market