Industry

Mezzanine Management seeks €250m for fourth fund

Alternative lender seeking тЌ40m commitment from EBRD for CEE-focused fund

Deal in Focus: NVM injects £2m into Lending Works

Peer-to-peer lending platform is to undertake a recruitment drive

Benelux: alternative lenders to the rescue

With Benelux deals on the wane, could more flexible financing methods unclog the region's private equity market?

CEE exit pace rebounds on strong macro

So far in 2016, unquote” data has recorded the highest volume of exits in H1 since 2013

MML promotes three to director

MML Capital has promoted Chivers, Devenshire and Shaw to directors

German PE develops a growing appetite for startups

VCs including Earlybird's Brandis discuss the growing trend of private equity houses taking part in growth capital deals within the country

Verdane holds SEK 3bn final close for ninth fund

Nordic private equity firm closes fundraising after just four months on the road

EdRip acquires Acto Mezzanine from ACG Capital

ACG had acquired the activity from Groupama Private Equity in 2013

French PE must exploit "momentum", says new Afic chair

Olivier Millet outlines his key priorities in an interview with unquote" following his appointment

Astorg closes Astorg VI fund on €2.1bn extended hard-cap

GP's fourth fund closes above original €1.5bn target and €2bn hard-cap

CVC closes latest debt fund on €650m

Vehicle will target European stressed and distressed corporate credit

Ratos deputy CEO Blomé quits

Deputy CEO to follow recently fired CEO Susanna Campbell and leave listed GP

Brexit could boost secondaries market, says Idinvest's Bavière

Idinvest CEO Christophe BaviУЈre calls for a measured approach to evaluating the long-term impact of the British referendum

Clessidra hires CEO & vice-chair after Bottinelli departure

Following the acquisition by Italmobiliare, Clessidra has appointed a new CEO and a vice-chair

Verdane Capital raising $200m ninth fund

Nordic-based direct secondaries, growth and buyout private equity firm begins fundraising

Pavilion acquires Altius

Predicted consolidation in funds-of-funds space comes to fruition with Pavilion's purchase of Altius

BlackFin Capital Partners launches €120m VC fund

Fintech fund is the financed-focus GP's first venture capital fund

Brexit: first reactions

Following the announcement that the UK is to leave the European Union, unquote" reports on PE's initial reactions

Blackstone's Murphy succeeds Römer as Invest Europe chair

Blackstone senior managing director Gerry Murphy speaks to unquote" in the wake of his appointment

Lack of Nordic exits a sign of weak portfolios, says Altor's Mix

Conditions in the Nordic markets could hardly be better for private equity exits, Harald Mix said at a conference

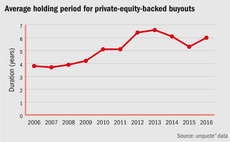

Holding periods lengthening again following 2015 drop

Holding periods for assets exited in so far 2016 have climbed following a drop in 2015, but still sit lower than the 2012-2014 average

Barker, Barnes step down from Electra board

Kate Barker served as interim chair following Roger Yates's resignation, until the appointment of Neil Johnson

Nordic mid-market mezzanine's malaise

Mid-market mezzanine has been all but entirely squeezed out of the Nordic private equity space

CapMan recruits Ratos's Pålsson as partner

PУЅlssonтs departure for the Finnish buyout house comes a week after Ratos announces CEO change