Industry

The advent of a new fundraising breed

Recent fundraising success shows it’s not about fees, but about distributions, people and integrity. Kimberly Romaine investigates

EBRD loans RUB 1.7bn to Orient Express Bank

The European Bank for Reconstruction and Development (EBRD) has provided Orient Express Bank (OEB) with a three-year loan totalling RUB 1.7bn.

Sberbank and Credit Suisse abandon buyout fund plans

OAO Sberbank and Credit Suisse Group have abandoned plans to raise a $1bn buyout fund dedicated to private equity in Russia.

One Equity Partners considers Turkish chem business

One Equity Partners and the Turkish army pension fund Oyak have been bidding to buy a stake in Turkish chemicals firm Akdeniz Kimya, according to reports.

Mobeus launches linked VCT fundraising

Mobeus Equity Partners has launched its third annual linked fundraising for its three VCTs.

VCTs launch; Puma offers incentive

This past week has seen a number of VCTs launch fundraises.

Biffa: A rubbish buyout?

A rubbish buyout?

EU and Switzerland strike agreement on fund supervision

A new cooperation agreement between the Swiss and EU regulators allows information sharing regarding the cross-border operations of alternative investment funds.

GPs tackle Italy's PR problem

Italy’s PR problem

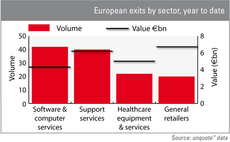

Software and retail lead 2012 exit league

General retailers and software & computer services lead the exit rankings for 2012.

Nordic PE investment fell in Q3

Private equity funds invested around тЌ1.1bn in the Nordics in the third quarter, тЌ750m less than in Q2, according to the Argentum Q3 2012 Report. The figures paint Q3 as the trough for the region this year.

France's fiscal cliff-hanger

Fiscal cliff-hanger

Leverage not a conclusive factor to explain insolvencies, academics say

Debt is not a conclusive factor in explaining insolvencies for portfolio companies, and PE-backed businesses do not carry more insolvency risk than other companies, according to new research by Imperial College London and Leeds University.

Electra Private Equity reduces discount to NAV

Electra Private Equity improved its discount to NAV ratio and recorded higher exit and investment activity in the past year.

LPEQ updates reporting guidelines

LPEQ has updated its reporting guidelines for listed private equity funds following feedback from stakeholders.

Better Capital still trades above NAV

Listed PE firm Better Capital has continued to trade above its NAV per share in the six-month period ending on 30 September 2012.

Apollo negotiates stake in Aurum Holdings

Apollo Global Management has shown interest in acquiring a stake in British jewellery company Aurum Holdings, according to The Telegraph.

French deal volume at 14-year low

French investment volumes in 2012 are set to be the lowest seen in the country for over a decade, according to the latest figures from unquote” data.

Herkules Capital's Pronova BioPharma receives takeover bid

Herkules Capital's Norwegian portfolio company Pronova BioPharma has received a voluntary cash offer from German chemicals company BASF SE.

Interview: SVB's Allan Majotra

Anneken Tappe speaks to Allan Majotra, director of Silicon Valley Bank’s Private Equity Services Group, about the role of funds-of-funds and regulatory developments.

Warburg Pincus-backed Premier Foods to cut 900 jobs

Warburg Pincus portfolio company Premier Foods has announced plans to shut down two bakery sites in Greenford and Birmingham next year, in addition to the previously announced closure of its Eastleigh bakery. The decision will result in 900 job losses...

Volume of exits increases in October

After a slow September, exits picked up again last month, but overall volume seems lower as the year comes to an end.

Top 5 largest funds of all time

Last week, Advent International raised one of the biggest private equity funds investing in Europe in recent years, but how does it compare with the largest funds of all time?

Report indicates tough times for PE ahead

GPs are increasingly negative about fundraising and worried about the impact of the economy on their portfolio companies, according to Grant Thornton’s latest private equity report. Anneken Tappe reports