Industry

The pitfalls of turnaround investing

Turnarounds are in the news once again, with the decision by specialist investor OpCapita to put struggling electricals retailer Comet into administration. Last week, Deloitte took over the administration of the business, and on Monday made over 300 staff...

CapMan Buyout X holds first close

CapMan Buyout X has held a first close at тЌ152m.

EIF commits €20m to Aster Capital cleantech fund

The European Investment Fund has committed €20m to the French cleantech venture fund Aster II.

3i on track with restructuring plan

3i says it is continuing to make progress in reducing its cost and debts as part of its restructuring plan announced in June.

Apollo officially launches new $12bn fund

Global private equity house Apollo Global Management has started marketing its eighth buyout fund with a $12bn target, co-founder Josh Harris announced during a presentation at the Bank of America Merrill Lynch Banking and Financial Services conference...

Sweden continues to lead Nordics

Sweden outpaced its Scandinavian neighbours in the 12 months leading up to November. A SVCA study shows that industry optimism returned just in time for year-end.

Nomura targets PE-like returns with new index

Nomura and QES (Quantitative Equity Strategies) have launched the daily investible long-only index PERI (Modelled Private Equity Returns Index).

Sofinnova closes largest European life sciences fund in years

Sofinnova Partners is due to announce a final close on its seventh life sciences fund in the second week of December, unquote” has learned. Kimberly Romaine reports

Carlyle back in the black

The Carlyle Group reported net income of $219m in Q3, returning to profit after last year's loss of $191m.

Partners Group completes secondary share offering

Partners Group has successfully sold an additional 3,350,001 shares at CHF 183 per share on the SIX Swiss Exchange.

Eurazeo and IDI post positive figures for Q3

French listed PE players Eurazeo and IDI have seen an uptick in their NAV per share in the three months between June and September.

Swedish authorities continue to press for tax change

Sweden's tax authorities are vehemently pushing for a change in the taxation of proceeds for private equity fund managers.

JP Morgan aiming to boost PE division

JP Morgan Private Equity (JPEL) has announced measures to increase capital returns to shareholders, which the firm says have been limited since the financial crisis.

Listed PE yields results

The investment landscape is rapidly transforming, reshaping itself almost beyond recognition as past follies take their toll on institutional investment powerhouses and new investors arise to take their roles in this new world. But will the much maligned...

The irrelevance of fees

Fees: irrelevant?

Turkey rises to the challenge

Turkey is slowly but surely establishing itself as a prominent market for private equity in Central and Eastern Europe along with Russia and Poland.

Silicon Valley Bank provides credit to Carlyle's The Foundry

Silicon Valley Bank (SVB) has provided a new credit facility to Carlyle's software holding The Foundry.

French tax reforms getting carried away

The Loi de Finances 2013 introduces a number of measures likely to impact French PE firms. Greg Gille talks to Herbert Smith Freehills’ Jérôme Le Berre (pictured) to find out what the implications are for future investments.

Buyout loan issuance down 38% YoY, says Baird study

European figures for leveraged and buyout loan issuance are down 46% at €20bn and 38% at €10bn respectively, according to recent research by Baird.

Escaping the equity black hole

The European M&A market continues to be depressed - as are many of the advisers in the sector. However, there are a number of tactics that interested parties and their advisers can pro-actively employ to help facilitate a transaction when it might otherwise...

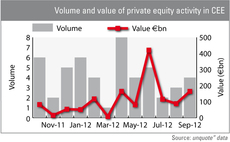

Industrials and consumer see most volume in 2012 to date

The industrial and consumer sectors outperformed other major industries in terms of deal volume between January and September 2012.

No fundraising "doom and gloom" – SJ Berwin's Sonya Pauls

Sonya Pauls on fundraising

Private equity becomes election battleground

Election battleground

French VCs appeal to French president over budget

Representatives from a raft of French venture capital firms have joined entrepreneurs in sending an open letter to President François Hollande raising concerns over measures introduced in the country's new budget proposal.