Performance

3i continues focus on disposals

Listed private equity firm 3i is continuing to boost divestment activity, while new investments remain subdued, according to the firm's latest half-yearly results.

Q3 Barometer: European deal volumes drop to 2005 lows

Findings from the latest unquote” Private Equity Barometer, published in association with SL Capital Partners, reveal a worrying drop in deal volumes, falling to the same level as Q4 2005.

Kinnevik appoints Stenbeck as executive chairman

Cristina Stenbeck, Investment AB Kinnevik

British Private Equity Awards: shortlist announced

Awards shortlist

Lack of exits forces Candover to make contingency plans

Without any realisations in the first half of this year and a growing debt burden, listed entity Candover Investments has started to review a range of alternative plans including refinancing existing facilities.

Eurazeo sees 2.1x return on divestments in H1 2013

Eurazeo made an average 2.1x multiple on €853m worth of disposal proceeds in the first half of this year, representing 23% of its portfolio.

Ratos reports SEK 820m net profit for H1

Listed private equity firm Ratos made an SEK 820m profit before tax for the first half of 2013, compared with an SEK 16m loss in H1 2012.

Exit focus: Italy's Ambienta reaps three-digit IRR

Exit focus: Tower Light

Exit focus: Italy's Ambienta reaps three-digit IRR

Exit focus: Tower Light

SVG enjoys 23% NAV boost in H1

SVG Capital has reported a 23% uplift in net asset value (NAV) in its half-year results, with shares now trading at 480p.

French PE still outperforms rest of continental Europe

French private equity funds have returned 8.6% since inception, according to the latest performance figures published by local trade body AFIC.

Popular high-yield bond market shrinks refinancing wall

A new report has found that amend-and-extend activity has reduced the expected 2014-2015 refinancing wall.

UK private equity industry proves downturn resilience

UK private equity and venture capital funds generated a 6% 5-year IRR during the five years throughout the financial crisis, outperforming the 2.5% achieved by the FTSE All-Share, according to a recently published study.

Gimv makes 1.3x return on divestments for 2012/13

Gimv has announced a 1.3x return on divestments, relative to original acquisition value, for the year ending in March 2013.

3i reports 11.5% NAV increase

3i has seen its NAV per share rise 11.5% over the past 12 months, and says it is making significant progress to turn around the business.

Ratos reaps SEK 898m exit proceeds in Q1

Listed private equity house Ratos made SEK 898m in exit gains and SEK 798m in net profits in the first quarter, according to the company's latest report.

Family offices set to increase PE allocations

Family offices

Eurazeo posts 16% NAV increase in 2012

French listed buyout firm Eurazeo saw its NAV increase by 16% in 2012, fuelled by improved contributions from portfolio companies and an acceleration of divestments over the past six months.

HgCapital Trust sees NAV rise by 15% in 2012

HgCapital Trust, the listed vehicle investing in all of Hg's private equity transactions, has reported a 15% increase in NAV per diluted share over the course of 2012.

Carlyle earnings disappoint

Carlyle Group's economic net income has declined by 28% compared to last year, causing its share price to fall by almost 8%.

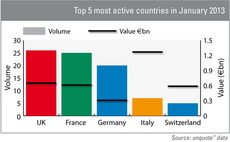

Italy shines in January thanks to CVC mega-buyout

Italy topped Europe's private equity value charts in January, while the UK recorded the most deals, showing both familiar names and outliers starting 2013 on a high.

Ratos made SEK 363m loss in Q4

Ratos made a net loss of SEK 363m in the fourth quarter of 2012 and expects the downwards trend to continue during the first half of 2013.

CapMan to hire new CEO

CapManтs board of directors has started a search process to replace its current CEO Lennart Simonsen, who is resigning from his position as part of the firmтs development programme.

Early-stage deals bounce back in Q4

After a slow summer, early-stage investments took off in Q4, according to the latest unquote” Private Equity Barometer, published in association with Arle Capital Partners.