Performance

Retail sector activity benefits from economic woes

The current economy has forced most retail businesses to rethink their strategy, leaving enough space for private equity firms to come in and get their share.

Germany quiets down in Q4

After a substantial increase in deal activity in Q3, the German private equity market grew quieter again towards the end of 2012.

Cinemas could be the big deal in 2013

While Terra Firma is considering getting out of the movie business, its private equity competitors could see some very attractive investment opportunities this year.

Headcount and turnover on the rise for French PE-backed businesses

French private equity-backed companies have seen their turnover and headcount grow by 9.1% and 5.2% respectively in 2011, according to a recent study by trade body AFIC and Ernst & Young.

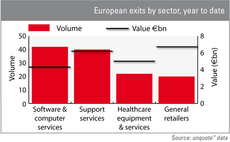

Software and retail lead 2012 exit league

General retailers and software & computer services lead the exit rankings for 2012.

Nordic PE investment fell in Q3

Private equity funds invested around тЌ1.1bn in the Nordics in the third quarter, тЌ750m less than in Q2, according to the Argentum Q3 2012 Report. The figures paint Q3 as the trough for the region this year.

Leverage not a conclusive factor to explain insolvencies, academics say

Debt is not a conclusive factor in explaining insolvencies for portfolio companies, and PE-backed businesses do not carry more insolvency risk than other companies, according to new research by Imperial College London and Leeds University.

Electra Private Equity reduces discount to NAV

Electra Private Equity improved its discount to NAV ratio and recorded higher exit and investment activity in the past year.

Better Capital still trades above NAV

Listed PE firm Better Capital has continued to trade above its NAV per share in the six-month period ending on 30 September 2012.

French deal volume at 14-year low

French investment volumes in 2012 are set to be the lowest seen in the country for over a decade, according to the latest figures from unquote” data.

Volume of exits increases in October

After a slow September, exits picked up again last month, but overall volume seems lower as the year comes to an end.

Sweden continues to lead Nordics

Sweden outpaced its Scandinavian neighbours in the 12 months leading up to November. A SVCA study shows that industry optimism returned just in time for year-end.

Carlyle back in the black

The Carlyle Group reported net income of $219m in Q3, returning to profit after last year's loss of $191m.

Eurazeo and IDI post positive figures for Q3

French listed PE players Eurazeo and IDI have seen an uptick in their NAV per share in the three months between June and September.

Turkey rises to the challenge

Turkey is slowly but surely establishing itself as a prominent market for private equity in Central and Eastern Europe along with Russia and Poland.

Industrials and consumer see most volume in 2012 to date

The industrial and consumer sectors outperformed other major industries in terms of deal volume between January and September 2012.

The unquote" forecast: Total buyouts fall by 22% in 2012

After buyouts picked up again in 2010 and 2011, this year's forecast predicts a drop in both value and volume. Anneken Tappe reports

Blackstone records strongest quarter since IPO

The Blackstone Group beat expectations with its positive earnings report, showing a strong recovery year-on-year.

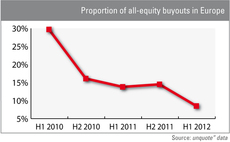

Spread between leverage and all-equity deals widens on investor scepticism

All-equity deals are decreasing as a percentage of overall buyouts, indicating investors are adopting a "wait-and-see" approach to financing.

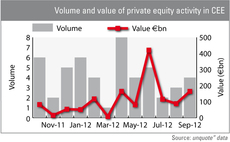

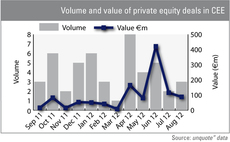

CEE picking up the pace

Dealflow in the CEE region picked up slightly in August, and the handful of deals closed so far in September hints at a busy Autumn ahead.

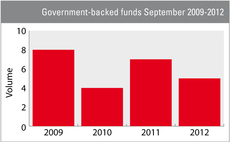

2012 sees fewer state-backed funds

Fewer government-backed funds have been launched in 2012 than in previous crisis years, suggesting that either the market is picking up, or that even governments' aid efforts are failing.

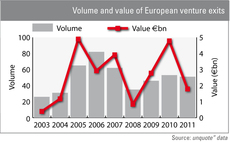

Successful exits bring venture back into the game

Venture is bouncing back since its 2008 trough, and now sees over 50 exits per year in Europe. These exits are not just about quantity, but also quality, with some of Europe's best-loved VCs sharing the limelight with lesser known players.

Access to growth finance a key concern for UK businesses, ECI survey shows

ECI Partners' 2012 Growth Survey of UK SMEs reveals the business climate is still impacted by the UK's dependency on European trade and the difficulty in securing finance.

Candover NAV per share drops 10%

Listed private equity firm Candover Investments has announced a NAV per share of 642p at 30 June, down 10% from 717p at the end of December 2011.