Benelux

IK to sell 2Connect in SBO to Rivean

Management of the Dutch cable and connectors manufacturer will reinvest in the transaction

EMZ in final stretch of EUR 1.2bn EMZ 10 fundraise

EMZ 10 held a first close in excess of EUR 800m earlier in May and continues to seek new LPs

Argos Wityu appoints head of ESG

Jessica Peters joins the sponsor’s Brussels office to further integrate ESG into the GP and its portfolio companies

Equistone files seventh buyout fund

Equistone VI was 61% deployed as of December 2021 and has made 26 investments to date against the 25-30 deals it can make

Tikehau, Unilever, Axa form EUR 1bn impact fund

Each party has made a EUR 100m commitment and the agriculture-focused fund is now open to new LPs

Schroders gears up for new VC fund-of-funds

Schroders Capital Private Equity Global Innovation Management XI has been registered in Luxembourg

Ergon holds EUR 800m final close for Fund V

New EUR 800m fund is almost 40% larger than its EUR 580m, 2018-vintage predecessor

QPE backs MBO of Republic M!

The buyout of the British commercial services outsourcer is QPE's seventh platform deal under its maiden fund

Naxicap preps for Fund III with eyes set on DACH, Benelux expansion

Sponsor expected to hit the road “soon” for its new EUR 1bn-plus small mid-cap buyout fund

Endeit Capital extends third fund to EUR 303m

Fund's EUR 250m 2021 final close has been extended by commitments from the KfW and existing LPs

Silverfleet to exit STAXS in trade sale

Sale of Dutch cleanroom consumables distributor to Haniel-owned CWS Cleanrooms will deliver a 6x money multiple for the sponsor

Opportunity Partners shops Beelen.nl in Rothschild-led sale

Dutch demolition services provider will be marketed off around EUR 20m EBITDA, with IMs expected to be distributed imminently

WeTransfer sponsor to revisit exit plans later this year

Owner Highland Capital could opt for private sale as choppy market conditions make IPO more difficult

Main sells LOCATIQS to PE-backed Sogelink

Owned by Keensight, the combined group will have around EUR 120m revenues and will seek further acquisitions

Stirling Square gears up for fifth fund

Fund registration comes just over two years after the EUR 950m final close of Stirling Square IV

EQT sets Fund X hard-cap at EUR 21.5bn

GP is also on the road for funds including its EUR 4bn, impact-focused EQT Future Fund

Main sells Obi4wan to PE-backed Spotler

Exit to CNBB portfolio company Spotler Group ends a holding period of almost six years

The Bolt-Ons Digest – 19 April 2022

Triton's All4Labels; Committed's MR Marine; Goldman Sach's Advania; Main Capital's Perbility; and more

Buyout groups circle Trivium Packaging auction

Owners OTPP and Ardagh requested non-binding offers last week after distributing sale materials in March

Convent Capital holds first close for Agri Food Growth Fund

Growth capital vehicle will invest EUR 5m-EUR 20m per deal and has made its first investment

Parcom prepares insurance provider TAF for exit

Parcom acquired a majority stake in the Netherlands-based business in December 2018

European PE fundraising forges ahead amidst macro uncertainty

Unquote explores LP preferences, GP behaviour and the challenges ahead in what many expect to be a record fundraising year

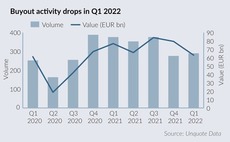

European Q1 deal value drops amid market volatility

Buyouts in the first quarter fell to EUR 62bn, the lowest level since the recovery from the pandemic started

MPEP holds EUR 215m interim close for fourth PE fund

GP expects to reach its EUR 300m target for Munich Private Equity Partners IV by summer 2022