Benelux

Optimism prevails as PEs expect step-up in deal-making – research

Third Bridge's Joshua Maxey speaks to Unquote about the findings of the Mid-market PE Forecast: 2022

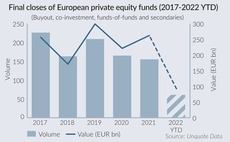

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Final closes down by almost half so far this year, but a number of "mega-cap" vehicles in coming months could still bolster 2022 fundraising

Bain Capital appoints advisers for Bugaboo exit

Dutch pram maker to hit the M&A pipeline in an auction guided by Baird and Barclays Capital

Cinven holds EUR 1.5bn final close for financial services fund

GP's first sector-focused fund has made three deals, the first of which was insurance broker Miller

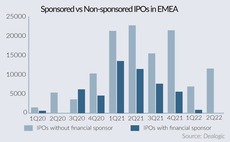

Corporates best placed for autumn IPO window as sponsors sit out

GPs expected to continue to ditch listings in the short term in favour of sale exits, longer holding periods

Curiosity VC eyes EUR 75m fund close in 2023

Dutch investor has commitments from 55 LPs for fund launched last year

Unigestion holds EUR 900m final close for fifth secondaries fund

Fund is more than three times the size of its predecessor and is more than 50% committed

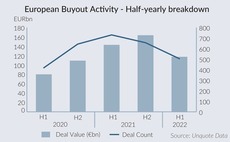

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Levine Leichtman Capital appoints head of Europe

Promotion of Josh Kaufman comes as GP looks to grow its nascent German investment capabilities

Phoenix Court Group raises USD 500m for four VC strategies

London-headquartered VC is raising for its LocalGlobe, Latitude, Solar and Basecamp funds

Kester nets 8x on Avania exit to Astorg

Medical device CRO is Astorg's first healthcare deal from its EUR 1.3bn Mid-Cap fund

GP Profile: Ergon hones in on long-term trends, ESG agenda

The European mid-market sponsor is eyeing growing and resilient businesses with its EUR 800m Fund V

LGT Capital closes first dedicated impact fund on USD 550m

Crown Impact will make co-investments, as well as primary and secondary fund investments

IK pauses Ampelmann auction amid macro concerns

Buyer interest dampened by Dutch offshore access systems developer's exposure to Russia

Gimv launches life sciences investment platform

Sponsor seeks to double portfolio and invest bigger tickets in drug development companies

Clearwater Multiples Heatmap: PE activity holds up amid war, inflation woes

Record levels of dry powder continue to bolster the resilience of the buyout market in Q1 2022

Main Capital on the road for debut growth fund with more fundraises in sight

New vintage of existing strategies and a healthcare-focused continuation fund are also on the agenda for the software-focused GP, according to founding partner and CEO Charly Zwemstra

Synergia plans EUR 200m Fund VI final close by end of 2022

GP is targeting family offices and entrepreneurs and aims to hold a EUR 150m first close by the end of June

Unigestion launches third Direct fund with EUR 1bn target

Strategy invests in mid-market companies alongside the GP's investment partner network

Forbion exceeds Growth Opportunities II target with EUR 470m first close

Biopharma GP sees growing demand for private capital amid IPO lull; gears up for EUR 600m hard-cap by summer end

LPs' net returns highest since financial crisis – Coller Capital

Secondaries specialistтs Summer 2022 Barometer shows that half of LPs want to increase their allocation to alternatives, with 91% still committing to PE first closes with incentives

Advent and Lanxess form EUR 3.7bn polymers JV with Royal DSM carve-out

Buyers pay EUR 3.7bn for DEM; the new unit has sales of over EUR 3bn and EBITDA of EUR 500m

Bain acquires majority stake in Naxicap-backed House of HR

Naxicap will continue its 10-year ownership period, retaining a minority stake in the HR services group

Goldman Sachs AM beats sponsors to buy Norgine

Buyer's PE arm competed with Bain and Cinven in the auction second round