European Q1 deal value drops amid market volatility

Private equity investment in Europe saw a notable drop in first quarter of the year amid major geopolitical and macroeconomic headwinds, Unquote Data shows.

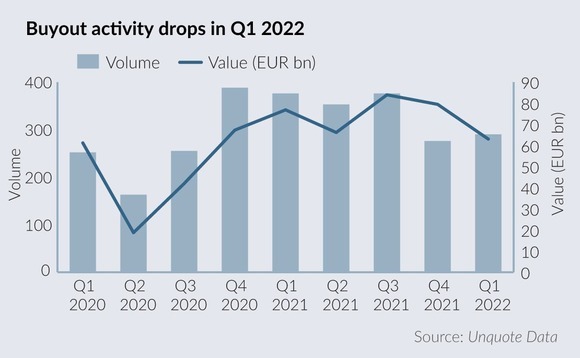

The value of private equity-led acquisitions fell to EUR 62bn in Q1, a drop of 23% compared to Q4 2021, which has sent buyout investment to its lowest levels since the COVID-19 recovery begun.

With 279 transactions, the number of PE-led acquisitions remained stable compared to Q4, although in the year-on-year comparison volumes were fell 25%.

Against a backdrop of rising inflation stoked by rising commodities and energy prices, which have been further inflamed by the ongoing Russian war in Ukraine, some market players are beginning to show concern with the rapidly cooling market.

"There was just not enough financing last quarter," one sponsor advisor said. "I am not sure when things will improve now that we are continuing with the slowdown in Q2. It's difficult to forecast in this inflationary environment."

The stalled auction of UK Pharmacy chain Boots is one of the casualties in the current jittery financing environment. Another sale processes that felt the heat included that of German phenolic resins maker Prefere Resins, with bidders concerned with its exposure to rising raw materials costs and its exposure to Russia.

The lull in activity stands in contrast to the record months of M&A between Q4 2020 and Q1 2021 when sponsors played catch up on deals that were stalled at the onset of the COVID-19 pandemic.

Business services boom

In Q1 this year, among the most active sector was industrials, with deals valued at EUR 21bn and 93 transactions registered – both figures represent a 20% jump from the same period last year.

Part of this was driven by megadeals, most notably KKR's acquisition of Dutch beverage bottler Refresco, valued at USD 8bn.

But much of the industrial activity was driven by its business services subsector, most notably the USD 7bn acquisition of testing services group Element Materials Technology by Singaporean sovereign wealth fund Temasek, as well as Apax Partner's acquisition of supply chain consultant Alcumus Group for GBP 600m during the quarter.

Such transactions have highlighted the appeal of assets that operate in technically demanding and highly regulated sectors. Industrial groups with strong technology platforms that can help run their operations more efficiently have also proved to be a draw for investors.

Technology persists

Meanwhile, buyout activity for technology deals has seen one of the most significant drops, with value and volume both plunging 40% year on year to EUR 8.5bn and 56 deals recorded.

The fall in activity coincides with the risk-off mood in the public market that has contributed to a 10% drop in the tech-heavy NASDAQ index during the first quarter of the year.

In spite of this, advisors and vendors continue to tout the importance of technology, as was laid bare by the pandemic, whether on personnel, operations, supply chains, distribution networks among other facets of business lives.

This means that technology valuations continue to hold up high. A recent report by Lincoln International show tech businesses were selling, on average, for 7.5x revenue multiples by end of last year, having grown from the 4.8x revenue multiple since 2018.

"There's always an anticipation of growth embedded in the tech valuation, with today's revenues and earnings going to be much more significant based on the demand of a particular market," said Richard Olson, managing director for Lincoln's valuations and opinions group.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds