Benelux

From PE darling to hard-hit sector: gyms face uncertain post-covid future

As gyms and fitness clubs across Europe gear up to welcome back consumers, Unquote explores their tricky path out of lockdown

Consortium in €20m round for Roamler

Investment will enable Roamler to internationally expand, starting with the UK and Germany

BlackRock and ApoBank launch healthcare fund

BlackRock-managed fund aims to give ApoBank's institutional clients access to healthcare investments

KKR to acquire Roompot from PAI

At the beginning of 2020, PAI hired Rothschild to sell the company for an expected valuation of €1bn

Fortino acquires majority stake in Sigma Conso

Fortino has acquired Sigma Conso alongside management to expand the company internationally

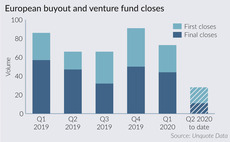

European fund closes slump by 42% amid lockdown

Unquote recorded 44 first or final closes of European PE funds between March and May, a 42% drop on the three-month average seen across 2019

Meta Change Capital launches €100m fund

Fund is dedicated to investments in blockchain companies across Europe, Asia, the Middle East and Africa

Vast majority of LPs satisfied with GP transparency – survey

Coller Capital's PE Barometer also reported LP concerns about forward-looking EBITDA add-backs

Secondaries players weigh up risk and rewards of "ring-fencing" deals

GP-led transactions isolating assets hardest hit by the Covid-19 crisis could appeal to adventurous secondaries players, but challenges abound

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Third of LPs put fund commitments on hold – survey

Brackendale Consulting survey also revealed that 62% would commit to a fund without a personal visit

Cerea to launch third buyout fund

Cerea also plans to launch its fourth mezzanine vehicle with a тЌ250-275m target next month

Elaia, BPI France in €21m series-C for iBanFirst

Fresh capital will be used to expand the company's financial services platform

Video: CPPIB's Delaney Brown on improved LP/GP relations

In the fourth of Unquote's Lockdown series, Delaney Brown, managing director of CPPIB, discusses improved GP/LP relations since lockdown began

Hg leads $30m series-B for Silverfin

Existing shareholders Pieterjan Bouten and Louis Jonckheere will leave the company

BB Capital buys majority stake in Infradax

Deal is the GP's second acquisition of 2020, following skin care clinic chain Cosmetique Totale

Ysios Capital raises €155m for third biotech fund

Ysios BioFund III provides financing to early- and mid-stage, highly innovative life sciences companies

Main Capital-backed Inergy buys Frontin

Acquisition of the Netherlands-based municipal financing software is Inergy's second add-on

Unquote Private Equity Podcast: Startups slow down

The Unquote pod asks, when will VC activity return to normal? And how will venture funds rebound in comparison to the previous GFC?

K Fund launches €70m second vehicle

Fund targets companies operating in the internet and mobile technology sectors

Francisco Partners raises $9.7bn across three funds

Funds target the technology industry, with a focus on software, financial technology and healthcare IT

Two thirds of PE professionals expect reduction in carry – survey

More than half of the private equity partners and directors surveyed also expect bonuses to reduce

Eurazeo holds €400m first close for France-China Cooperation Fund

Fund targets European companies with expansion and growth plans in the Chinese market

Torqx acquires Fabory

Grainger, the vendor of the company, mandated Rothschild to explore a sale process in November 2019