Benelux

Henq injects €1.1m into SEOshop series-A

Henq Venture Capital has invested €1.1m in Dutch online store provider SEOshop, marking the completion of the company's series-A funding round.

Gimv backs €40m investment in Lampiris

Gimv has jointly invested €40m in Belgian green energy supplier Lampiris with the Regional Investment Company of Wallonia (SRIW).

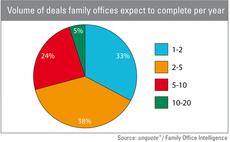

Family offices seek surge in deal origination

Family offices

HG International trades hands between Gilde funds

Gilde Equity Management Benelux (GEM) has sold Dutch cleaning products supplier HG International BV to the GP's sister division, Gilde Buyout Partners (GBP).

CVC to sell 32.5% stake in bpost IPO

CVC Capital Partners plans to sell a stake of up to 32.5% in the IPO of bpost at a price of €14.5 per share.

CVC's bpost shares to sell for €12.5-15

Shares in bpost, the Belgian postal service backed by CVC, will sell for €12.5-15 in the business's upcoming IPO, according to reports.

VC-backed Cardio3 announces IPO plans

Belgian biopharmaceutical company Cardio3 Biosciences, which is backed by a consortium of venture capital firms, has announced that it is considering listing new shares in an IPO.

Lion cleared to sell Ad van Geloven stake to Avedon

Lion Capital has received clearance from the European Commission to sell a stake in Dutch frozen snack company Ad van Geloven to Avedon Capital Partners.

HgCapital sells ATC to Intertrust for €303m

HgCapital has sold Dutch fiduciary services firm ATC to corporate services business Intertrust for €303m, reaping a 2.2x money multiple.

Metastudy: Private equity drives innovation and growth

A new secondary research report has found that private equity investing leads to increased foreign investment and improvements in innovation.

Main Capital exits Iaso in trade sale

Main Capital Partners has exited Netherlands-based Iaso Backup Technology to US-based trade player GFI Software in a “double-digit-million-euro transaction”.

Gimv makes 1.3x return on divestments for 2012/13

Gimv has announced a 1.3x return on divestments, relative to original acquisition value, for the year ending in March 2013.

EU postpones Solvency II rules on pensions

The European Commission has postponed a bid to apply Solvency II style rules to pension funds as part of the revised IORP Directive.

CVC to list bpost shares in IPO

CVC Capital Partners plans on listing a minority portion of its shares in Belgian postal service bpost in the business's upcoming IPO on the NYSE Euronext in Brussels.

Beechbrook mezzanine fund hits €67m first close

Northern European investor Beechbrook Capital has raised тЌ67m for its latest mezzanine fund at first close.

BlueBay reaches €800m final close for Direct Lending Fund

BlueBay Asset Management has held a final close for its Direct Lending Fund after exceeding its initial тЌ500m target.

NPM buys 25% of FibreMax

NPM Capital has acquired a 25% stake in Dutch lightweight precision cable manufacturer FibreMax.

GMT and Veronis buy IT-Ernity from Nedvest

GMT Communications Partners and Veronis Suhler Stevenson have bought a majority stake in IT-Ernity from Nedvest Capital.

Benelux unquote" May 2013

Benelux punched above its weight in April with two private equity-backed IPOs, following on from other listings in recent weeks.

Bayside and LBO France inject fresh money into Consolis

Bayside Capital and owner LBO France have respectively injected €45m of new debt and an equal amount of fresh equity into the refinancing of Belgian concrete manufacturer Consolis.

Cardio3 raises €19m in new funding round

Belgian biopharmaceutical company Cardio3 Biosciences has completed a funding round that saw previous investors inject €7m in new equity alongside the conversion of €12m in existing convertible loans.

H2 makes 6x on Sator sale

H2 Equity Partners has reaped a 6x multiple on the trade sale of Dutch portfolio company Sator Holding to LKQ for £176m.

Delta Lloyd drops out of private equity

Delta Lloyd has disposed of the private equity management arm of its investment division, Cyrte Investments BV, and will reportedly no longer deal in the private equity sector in the wake of the Solvency II directive.

Newion acquires stake in Reasult

Newion Investments has acquired a minority stake in real estate software provider Reasult via its third fund, Newion II.