Benelux

Fortis PE and Next Invest sell Arets to Toyo Ink for €10m

Fortis Private Equity and asset manager Next Invest have sold their joint 100% stake in Belgian ink manufacturer Arets International to Japanese ink company Toyo Ink Group for €10m.

Cinven and Warburg Pincus in final exit from Ziggo

Cinven and Warburg Pincus have reaped €3.4bn on their full exit from Ziggo, the Dutch cable operator that the firms took public on NYSE Euronext in Amsterdam last year.

H2 Equity Partners sells Sator to LKQ

H2 Equity Partners has sold Dutch portfolio company Sator Holding to UK-based auto parts distributor Euro Car Parts for £176m.

Main Capital acquires Connexys

Main Capital Partners has acquired a majority stake in Dutch software company Connexys.

PE-backed Intelsat misses IPO target

Luxembourg-based satellite operator Intelsat SA, which is backed by BC Partners and Silver Lake Partners, fell more than $100m short of its target at yesterday’s close on the NYSE.

Apollo's Taminco in disappointing stock exchange debut

Shares in Taminco, the Belgian chemical business backed by Apollo, dropped by around 8% to $14.05 yesterday, shortly after the firm listed on the New York Stock Exchange.

LP interview: The secondaries saga

Founded in 1991, London-based Paul Capital has decades of experience in secondaries and fund-of-funds investments. unquote" talks to secondaries specialist and partner Elaine Small about the drivers behind the market's unprecedented growth.

3i's Refresco merges with Gerber Emig

Refresco, a Dutch beverage manufacturer backed by 3i, will merge with European bottling company Gerber Emig.

CVC to list shares in bpost

CVC Capital Partners plans to list its shares in Belgian postal service bpost on the stock market and has already appointed banks to coordinate the sale, according to reports.

Benelux unquote" April 2013

Exits have dominated the Benelux market in the past month, but the disposals were not all good news for private equity in the region.

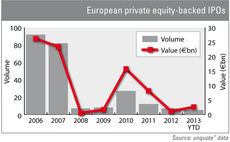

IPO activity dwarfs 2012 after first quarter

Private equity-backed IPOs are making a major comeback and could be set to reach their highest level since 2010, according to figures from unquoteт data.

Benelux spirits lifted as exits rise

Benelux exits

Rhône Capital buys bakery businesses for €1.05bn

Rhône Capital has agreed to take private the bakery supplies businesses from listed Dutch food ingredients group CSM for an enterprise value of €1.05bn.

Runa Capital leads $2m round for BackupAgent

Runa Capital has led a $2m funding round for Dutch cloud technology company BackupAgent.

Apax France sells Numericable B&L and Cabovisao stakes

Apax France has agreed to sell its stakes in cable operators Numericable Belgium/Luxembourg and Cabovisao to co-owner Altice.

Gimv's Verbinnen winds up

Gimv-backed Belgian food processing business Verbinnen Poultry Group has filed a petition to wind up on 25 February 2013 after failing to find a buyer.

Ogier opens Luxembourg office

Ogier Fiduciary Services, a provider of corporate, fund and private wealth administration services, has opened an office in Luxembourg.

Benelux unquote" March 2013

Banks in the Benelux are undergoing a major reshuffle, as those bailed out during the financial crisis seek to offload surplus assets, resulting in a boom for the secondaries market.

EQT appoints Nieuwenburg as new Benelux head

EQT Partners has appointed Kristiaan Nieuwenburg as partner and head of its Benelux operations.

Montagu Private Equity sells ADB to PAI partners

Montagu Private Equity has sold Belgian airport lighting specialist ADB Solutions to PAI partners.

PPM Oost sells Pharmaline to Gilde Healthcare Partners

PPM Oost has sold its stake in Dutch medical supplies company Pharmaline to Gilde Healthcare Partners.

Forbion Capital et al. back Dezima Pharma

Forbion Capital Partners and BioGeneration Ventures have led a €9.8m series-A funding round for Dutch biotechnology company Dezima Pharma.

Gimv launches Health & Care Fund

Gimv has launched a new €200m fund focused on healthcare and medical technology investments.

Inkef invests €7.5m in Sapiens

Inkef Capital has invested €7.5m in Dutch medical technology company Sapiens Steering Brain Stimulation (Sapiens), extending the company's series-A funding.