CEE

Purple Ventures plans EUR 30m-EUR 40m fund to invest across CEE

Early-stage investor expects to hold a EUR 20m-plus first close for its second fund by Q1 2024

The Bolt-Ons Digest - 26 May 2023

Unquoteтs selection of the latest add-ons with H&F's TeamSystem, Nordic Capital's Regnology, 3'i's Dutch Bakery and more

Q1 Barometer: Signs of a brighter future after dark times for European PE

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Women in PE: Innova Capital's Pasecka on consolidation and succession opportunities amid macro challenges

Magdalena Pasecka discusses the Polish GP’s fundraising and deployment plans, as well as advice for emerging leaders in the industry

European VCs need to match actions to words by increasing funding to female-led companies

Women-led startups usually receive less than 2% of VC capital, but more diverse, defensible female-founded businesses emerging

OTB Ventures heads for EUR 150m-plus final close of second fund next month

Deeptech-focused VC expects to make two to three more deals this year, Adam Niewinski said

Unquote Private Equity Podcast: Taking the plunge - GPs dive into alternative pools of capital

The Unquote team is joined by Thomas EskebУІk, CEO of private markets platform Titanbay, to discuss private marketsт search for alternative sources of commitments

CEIP eyes industrials and services targets with EUR 70m vehicle, aims for year-end fund close

Czech Republic-headquartered GP is open to co-investments from LPs and fellow sponsors; one further deal expected this year

Spire Capital Partners holds EUR 57m first close for debut digital/tech fund

CEE-focused sponsor has a EUR 100m hard-cap for its first fund and will deploy EUR 7m-EUR 15m tickets

GP Profile: Ardian Expansion doubles down on generalist approach, eyes EUR 3bn Q2 fundraise launch

With its current EUR 1.5bn fifth fund almost at full deployment, Ardianтs Expansion strategy expects to benefit from LP appetite for its strategy ahead of EUR 3bn fundraise

Women in VC: MMV's Brunet on tech opportunities and navigating volatile markets

Alix Brunet speaks to Unquote about the VC firmтs deal pipeline and how it is engaging with portfolio companies and new founders

Podcast: Q1 2023 - Bank runs, fund home runs and markets come undone

Unquoteтs reporting team discuss themes that have arisen in Q1 2023, ranging from liquidity management to venture and growth activity

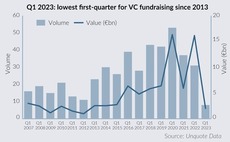

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

PE roll-up strategies face regulatory heat with focus on consumer industries

With longer holding periods facilitating more bolt-ons, regulators including the UK's CMA are intervening

ACP exits Akomex in MBO deal following three-year holding period

Paper packaging company’s revenue increased by 70% and EBITDA nearly doubled during ACP’s investment period

VC Profile: Target Global assesses B2B opportunities in final stretch of current fund deployment

Nearing full deployment for its second growth fund, pan-European VC firm outlines plans to back defensive B2B models and institutionalise its co-investment strategy and LP base

Half of LPs allocating to impact from generalist pool as market matures – Rede Partners

Jeremy Smith and Kristina Widegren speak to Unquote about key takeaways from the private capital adviserтs Private Markets Sustainability and Impact Report

European sponsors sidestep panic, concede gloom over bank woes

Fallout from Credit Suisse collapse adds to slew of macroeconomic challenges for PE dealmaking and fundraising

Nation 1 launches new early-stage, EUR 35m-EUR 40m fund

Czech investor targets first close in 1Q24, seeking to attract institutional investors and at least one bank

Deals face further financing uncertainty after Credit Suisse rescue

Delayed return of stabilized M&A conditions expected, advisors say; mid-cap transactions stand to fare best

Lenders sway fate of auctions in volatile LBO market

Vendors increasingly sounding out lenders before bidders to navigate uncertain M&A landscape

'The start-ups are just about alright': SVB fallout throws focus on UK tech capital demands

Silicon Valley Bank's demise might cause a small dent in confidence but should not have wider impact on the country's VC or tech sector

Unquote Private Equity Podcast: What's next for ESG – Fedrigoni case study

Harriet Matthews is joined by colleague William Cain to discuss ESG investing amid macro clouds and interviews Bainтs Ivano Sessa about the sustainability strategy for one of the sponsor's portfolio companies

Glass ceiling shows first cracks in PE space

Greater focus on investment team gender equality and mentoring has shifted the balance, but room for progress remains