CEE

Corporate divestments fuel European buyouts

Carve-outs and spin-outs represented around 14% of all buyouts in 2019, up from 11.5% in 2018 and 10% in 2017, according to Unquote Data

MCI to sell Netrisk

During MCI Group's holding period, the company bolted on Biztosítás.hu in 2019

Unquote Private Equity Podcast: Craving carve-outs

Listen to the latest episode of the Unquote Private Equity Podcast, where the team discusses corporate carve-outs

A decade to remember

The Unquote team wishes you a restful holiday break, and will be back for our regular news coverage on 3 January

Resource Partners acquires Maced

Tomasz Macionga will continue as CEO, while Edmund Macionga will join the supervisory board

Elbrus leads $10m round for YClients

Elbrus is currently investing from its $550m vehicle, which held a final close in February 2014

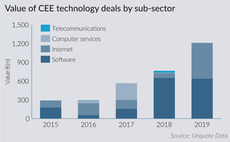

Software sector lures increasing amounts of capital in CEE

Interest in the software sector in CEE is on the up and was especially prominent in Q3

Private wealth to increase allocation to private equity

High-net-worth individuals and family offices are hunting for yield, concerned about low interest rates and market volatility

Poland's MCI gearing up for €400m maiden closed-ended fund

Vehicle will keep to MCI's strategy of backing buyouts of mid-cap technology businesses in the CEE region

Karma et al. back €1.5m round for MeetFrank

Company will use the capital to launch its new "relocation without location" feature

Jet Investment exits MSV Metal Studenka

Sale ends a six-year holding period for the GP, which bought the company via its Jet I fund

Lightspeed leads €128m round for Vinted

Funding round values Vinted at €1bn, making it Lithuania's first technology unicorn

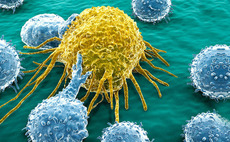

European biotech flourishes as US and Asian capital pours in

Attracted by a buoyant industry with a rich pipeline, numerous US and Asian players have entered the market

V4C buys stake in Warsaw-listed Summa Linguae

Deal is contingent upon the prior closing of two acquisitions by Summa Linguae

Carlyle-backed Logoplaste buys Masterchem

With this add-on, Logoplaste expects to expand its product offering and accelerate its growth

MGV holds first close for €150m early-stage fund

Fund achieves a тЌ75m first close and expects to hit its target by the end of 2020

Investindustrial closes seventh buyout fund on €3.75bn

Fund targets European companies operating in the consumer, industrial and healthcare services sectors

GHO Capital closes second healthcare fund on €975m

Fund targets companies operating in the healthcare industry, primarily pharma, medtech and outsourced services

Warburg Pincus Global Growth Fund raises $14.8bn

Fund targets companies operating in a wide range of sectors and deploys tickets in the $50-500m range

Level 20 names Pam Jackson as new chief exec

Jackson succedes Jeryl Andrew, who will retire from the role at the end of the year

Northzone closes ninth fund on $500m

NZ IX invests primarily in series-A and series-B rounds, financing companies based in Europe and the US

Turbine secures €3m seed funding round

Alan Barge, a partner at Delin Ventures, joins the board of directors of Turbine

CVC closes second growth fund on $1.6bn

Fund targets high-growth, mid-market technology companies based in North America and Europe

Mid Europa's Profi to acquire Pram Maya

Profi continues its expansion strategy by taking over Pram Maya's 18 stores in Prahova