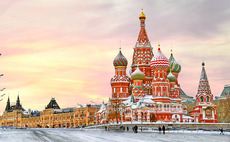

CEE

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Private equity seeks solutions to uncertainty as coronavirus derails buyouts

Dealmakers are trying to keep the buyout show on the road as the coronavirus crisis overtakes the European market

Coronavirus outbreak could lead to fundraising logjam, PE players warn

Industry participants contacted by Unquote expect negative ramifications for fundraising as well as deal-making activity

Enern nears close for VC fund, on road for growth vehicle

While the VC fund is largely committed, Enern is still open to hearing from interested parties

Secondaries deal volume up 7% in 2019 – research

Setter Capital's latest research reveals continued momentum in private equity secondaries, with 2020 set to be another record year

OTB Ventures closes debut fund on $100m

Fund deploys equity tickets of up to $15m in technology startups based in central and eastern Europe

Q4 Barometer: Continued buyout bonanza tops record-breaking year

Private equity investors completed 807 deals in Q4 2019, tipping the year into record-breaking territory

KKR closes Global Impact Fund on $1.3bn

Fund targets lower-mid-market companies in the Americas, Europe and Asia, which contribute to sustainable development

Springtide, MCI exit Geewa

Geewa's founder and shareholder, Milos Enderle, also sold his remaining 6% stake in the company

INVL closes Baltic Sea Growth Fund on €165m

Fund's predecessor, Invalda INVL, recorded an average 27% gross IRR and 2.4x money

Mercer closes Private Investment Partners V on $2.7bn

PIP V consists of a US vehicle for US investors and a Luxembourg vehicle for non-US investors

PVP fully acquires Avenir Medical Poland

In May 2018, PVP acquired an initial 56% stake in AMP from the company's founders

Direct lenders eye secondaries market for first-gen funds

Several European direct lenders are speaking to secondaries advisers about running processes on older vintage funds

RSBC acquires 50% stake in Umbrella

Pavel Steiner will remain CEO of Umbrella Invest Group, which will now operate under the new name

Highlander exits Akomex in management buy-back

Mezzanine Management, which is currently investing from its AMC IV fund, backs the management

Stirling Square closes fourth fund on €950m

Fund targets buyouts in European mid-market companies with enterprise values of тЌ50-500m

GreyBella Capital to launch new fund by mid-2020

Fund targets series-A and -B rounds in companies operating in life sciences and complex technologies

BHS acquires DCK Holoubkov Bohemia

With the capital injection, the company plans to exploit the export potential and expand the product range

Horizon buys 6.8% stake in Bucharest-listed Purcari Wineries

Horizon Capital is currently investing from EEGF III, its 2017-vintage $200m fund

Avallon holds €80.6m first closing for third fund

Fund completed its first deal, backing Poland-based household cleaning products manufacturer Clovin

RDIF et al. in Carprice, Travelata, Elementaree

RDIF is injecting capital jointly with its Russian, French and Middle Eastern partners

EI sells Danwood to trade for €140m

Enterprise Investors wholly acquired the company in a carve-out from Budimex in December 2013

Unquote Private Equity Podcast: the Review/Preview special

In this special bumper episode, the Unquote editorial team does a deep dive on key 2019 stats in each market

Sequoia leads $45m series-B for Productboard

Round also saw participation from Bessemer Venture Partners and existing investors