CEE

CEE: Gearing up for a busier 2012

Successes persevere in Central and Eastern Europe, despite subdued deal activity, and concerns over currency volatility and financing. Greg Gille reports

DFJ Esprit and Tempo Capital merge secondary businesses

VC firm DFJ Esprit and venture secondaries firm Tempo Capital are set to merge their venture secondaries businesses to form DFJ Esprit Secondaries.

Creative industries perceived as risky business

Unquoteт data reveals that the volume of investments in the creative industries has fallen while their value has risen. Investor risk aversion amidst economic volatility could be behind the fall in volume in a sector commonly perceived as risky business,...

Swiss tax treaties could open doors for further crackdowns

Sweden is the latest European country to sign a Rubik tax treaty with Switzerland. Sonnie Ehrendal reports

Regional investors vital for economic recovery

Regional devolution has been favoured by some private equity firms as a means of boosting dealflow. However, despite the merits of a regional presence, unquoteт data reveals that investments backed by regional players has fallen since 2005. Perhaps though,...

Sweden tops EC innovation despite incomplete eco-chain

Sweden has ranked highest in the European Innovation Union Scoreboard, but one industry professional has expressed his surprise at this success due to an тobvious lack in strategy for innovationт and тa terrible taxing system for entrepreneursт. Amy King...

BC European Capital IX closes at €6.5bn hard-cap

BC Partners has closed its ninth European Capital fund at the vehicle's тЌ6.5bn hard-cap.

EU leaders call for pan-European VC regime

Ahead of a summit on 1st March, David Cameron has joined 11 other EU leaders in a letter calling for the EU's economic policies to shift their focus from tough austerity cuts to growth-stimulating measures.

Partner promotions at CapMan

CapMan has announced a number of senior promotions.

Dodd-Frank fears "overblown"

The extensive requirements and wide reach of the US's Dodd-Frank Act has stirred up fears among European GPs. But law firm DLA Piper downplays worries, pointing to a number of available exemptions. Sonnie Ehrendal investigates.

Fragmented ecosystem hampering European venture

The debate surrounding the high returns enjoyed by Silicon Valley investors compared to their European counterparts continues. But why do stateside investments traditionally reap higher returns than those in European startups, and what needs to change...

Troika launches technology venture fund

Troika Ventures, backed by parent company Sberbank of Russia, has launched a $100m technology venture fund.

EI backs wind energy newco

Enterprise Investors has invested €40m in Polish wind farm newco Wento.

Jersey launches private placement scheme

Jersey has introduced a private placement scheme for institutional and professional investors.

Debt providers: "One-stop shops" gaining ground

Faced with a tough bank lending environment, PE houses are increasingly turning to тone-stop shopsт to leverage their deals. Indeed, alternative debt providers are looking forward to a busy 2012, as Greg Gille finds out.

Could mega fundraisings cause Nordic dry powder problem?

International investors have driven Nordic fundraising to unprecedented levels, but will deal flow keep up with the dry powder? Sonnie Ehrendal investigates.

Dechert opens in Frankfurt; poaches Mayer Brown partner

Private equity specialist Dr. Benedikt Weiser will join Dechert next month from Mayer Brown, where he was head of the firmтs German Private Investment Funds group.

Krokus invests in LOTOS Parafiny

Krokus Private Equity has backed the MBO of LOTOS Parafiny from LOTOS Group.

EBRD launches €100m technology venture fund

The European Bank for Reconstruction and Development (EBRD) has launched a venture capital programme for the technology sector.

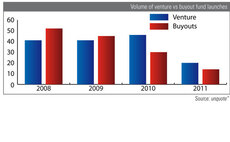

Volume of buyout vs venture fund launches

In 2010, launches of venture funds surpassed buyout funds for the first time in 5 years, but the gap has narrowed in 2011.

Access Capital Partners closes fund on €500m

Access Capital Partners has held a final close of its fifth European small- and mid-market fund-of-funds, Access Capital Fund V Growth Buy-out Europe (ACF V), on тЌ500m т above its initial target of тЌ350m.

IK Investment Partners hit by carried interest row

The Swedish tax authority's battle over carried interest taxation continues as another player is drawn into the feud. Sonnie Ehrendal investigates.

Summit Partners holds final closing of venture fund on $520m

Summit Partners has announced the final closing of the Summit Partners Venture Capital Fund III on $520m.

Summit Partners' eighth fund closes on $2.7bn

Summit Partners has announced the final closing of Summit Partners Growth Equity Fund VIII on $2.7bn.