DACH

Terra Firma's Deutsche Annington aims for 2013 IPO

Deutsche Annington, the German real estate group backed by Terra Firma, could pursue an IPO as early as 2013, according to reports.

ADCURAM closes first fund on €150m

ADCURAM Group has held a final close on its maiden fund, amounting to around €150m.

No fundraising "doom and gloom" – SJ Berwin's Sonya Pauls

Sonya Pauls on fundraising

Private equity becomes election battleground

Election battleground

Quadriga buys Hedrich Group

Quadriga Capital has backed the management buyout of Hedrich Group, a German manufacturer of electrical machinery.

Equita makes 10x money on Barat Ceramics exit

Equita Management has sold its majority stake in German oxide-ceramics maker Barat Ceramics to Steadfast Capital.

3i and Allianz looking to sell Scandlines

3i and Allianz Capital Partners are set to sell German-Danish ferry operator Scandlines, according to reports.

Q3 Barometer: European deal flow plummets 35%

Q3 Barometer

Triton to exit Ruetgers

Triton has sold German chemicals business Ruetgers to Indian industrial group Rain Commodities (Rain CII) for €702m.

Octopus leads $3m round for Faction

Octopus Investments has led a $3m funding round for ski equipment and apparel retailer The Faction Collective.

Holtzbrinck Ventures backs Musicplayr

Holtzbrinck Ventures is said to have invested €500,000 in German music platform start-up Musicplayr.

Kinnevik buys extra 10% of Zalando from existing investors

Kinnevik has acquired an additional 10% of shares of German online retailer Zalando for €287m from existing investors Holtzbrinck Ventures, Tengelmann and Rocket Internet.

T-Venture et al. invest in Netbiscuits

T-Venture invested in a $27m funding round for German software-as-a-service company Netbiscuits, led by Stripes Group.

LBBW and KfW invest in avandeo

LBBW Venture Capital and KfW Bankengruppe have invested in a second funding round for Munich-based furniture e-commerce business avandeo.

DACH unquote" October 2012

Recent studies by Rhodium Group and A Capital have suggested that Chinese investors could be in the early stages of a global shopping spree, with direct investment into Europe tripling in 2011 to $10bn.

DBAG exits Coperion to US trade player

Deutsche Beteiligungs AG (DBAG) and its co-investment fund DBAG Fund V have sold German mechanical engineering group Coperion to US trade buyer Hillenbrand in a deal understood to be worth €400m.

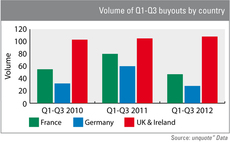

Data shows impact of continental crisis

Figures have outlined the extent to which the eurozone crisis, and other factors, have crippled the buyout market on the continent.

Advent launches takeover offer for Douglas

Advent International has made a tender offer to acquire listed German perfume and books retail group Douglas, which would value the business at close to €1.5bn.

Creathor Venture III holds final closing

German VC Creathor Venture has held a final close for its third fund on €80m.

Triton in renewed sale talks for Rütgers

Triton has reportedly put dividend recapitalisation plans for German chemicals business Rütgers on hold following renewed interest from strategic buyers.

German funds: The LPs' verdict

LP verdict

Germany Report 2012

In the unquote" Germany Report 2012, we take a look at how macro-economic issues are hampering German investment activity, despite its robust domestic market.

DACH PE Congress: Sourcing in a low-growth environment

With the eurocrisis overshadowing any economic and fiscal concern on the continent, GPs have to rethink how to successfully source deals and impress investors to secure commitments for future funds. Anneken Tappe reports from the unquote” DACH Private...

Aeris Capital et al. invest in Affimed Therapeutic series-D

Aeris Capital and existing investors have backed German biotech company Affimed Therapeutic in a €15.5m series-D round.