Data shows impact of continental crisis

Figures have outlined the extent to which the eurozone crisis, and other factors, have crippled the buyout market on the continent.

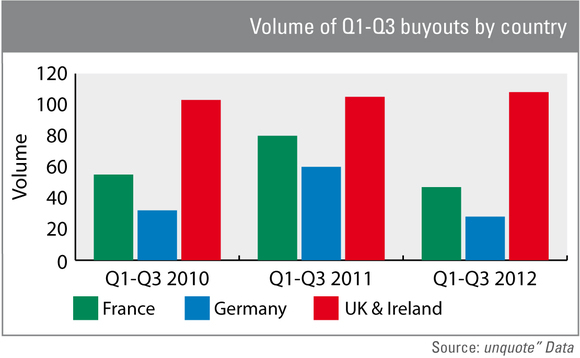

New research from unquote" data reveals that Europe's largest economies have seen deal numbers tumble, while the UK market has remained remarkably stable throughout the crisis.

In the first three quarters of 2012, 108 buyouts took place in the UK, compared to just 28 in Germany and 47 in France.

The numbers are a far cry from last year, when France had seen a huge 80 buyouts by the end of September, while by contrast the UK had seen only 105. Even in Germany, where the private equity model has found the business environment more challenging, saw more than twice as many deals, registering 60.

Furthermore, France and Germany's private equity markets are also both in a weaker position than in 2010, where the countries saw 55 and 32 deals respectively in the first nine months of the year.

The crisis in the southern European countries is clearly having a major effect on economic sentiment and business confidence in their northern neighbours.

Furthermore, while bank lending is depressed, there are also additional political pressures on the industry in both countries that are likely to further hamper growth of private equity in the coming years.

In France, new president Francois Hollande, who was elected in May this year, has introduced a budget that will see capital gains taxed at the same rate as income, much to the dismay of local industry association AFIC.

Meanwhile in Germany, the much-vaunted succession wave of mittlestand companies has so far failed to materialise, meaning the country's thriving mid-market remains difficult for financial investors to access. Additionally, Angela Merkel is set to face off against Peer Steinbrück, the newly elected SDP leader, a former finance minister who has taken an aggressive stance on leveraged finance, stating that banks should not lend to private equity firms.

The combination of political unrest and the potential for a messy Greek exit from the euro – not to mention the far scarier prospect of Spain's vast public debts – is, unsurprisingly, not instilling confidence in investors, and likely leading many players to wait and see how the crisis pans out before investing.

By contrast, the UK Government has largely put forth an image of being business friendly, and with a general election not likely until 2014, things are not set to change any time soon. Equally, although the UK economy is closely tied to Europe, the relatively stable currency and expectations of a minor economic recovery in 2013 seem sufficient to maintain investor interest.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds