DACH

360 Capital holds first closing of venture fund

Venture investor 360 Capital Partners has held a first close on its second fund, 360 Capital 2011, on more than тЌ60m.

EQT looking to exit Springer

EQT and the Government Investment Corporation of Singapore (GIC) are reportedly looking to sell German media giant Springer Science and Business Media.

Berlin: Europe's fastest growing tech hub

Berlin's tech hub

Cashing in on the drive for efficiency

Austerity politics can often seem at conflict with the idealised world of cleantech and renewable energy. With governments scaling back subsidies to reduce their deficits, it might seem that green investing will have slipped out of fashion. However, tough...

Four European mid-cap players team up, create Private Equity Network

Activa Capital, Graphite Capital, ECM and MCH have launched the Private Equity Network (PEN), a pan-European initiative designed to help their portfolio companies expand internationally.

vR and CBG Commerz back VELOX

vR Equity Partners and CBG Commerz Beteiligungskapital, the mezzanine arm of Commerzbank, have provided mezzanine funding for commodities distributor Velox.

Strong economy belies faltering buyout market in Germany

With debt scarcely available and cash-rich corporates looking to diversify through acquisitions, Germany’s buyout market has suffered a heavy blow these last few years - but it is still well-placed to take advantage of opportunities. John Bakie reports...

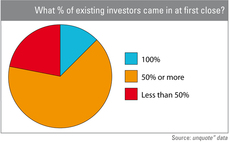

Fundraising research reveals optimism in tough times

Despite talk of apocalyptic investor behaviour, most GPs announcing a close this year reported existing LPs re-upping Т and even increasing ticket sizes, as revealed in an unquote" survey of more than 40 European GPs. Anneken Tappe reports

Motion Equity Partners exits ixetic

Motion Equity Partners (formerly Cognetas) has agreed to sell German car parts manufacturer ixetic to Canadian automotive supplier Magna, a deal reportedly worth €308m.

Gilde Healthcare Partners et al. back Definiens

Gilde Healthcare Partners has led a €10m funding round for German image analysis company Definiens.

GE Capital appoints German head of leveraged finance

GE Capital has appointed Ralph Betz as head of its German leveraged finance team in Frankfurt.

Video: David Currie - industry needs liquidity

As he steps down from 33 years in private equity, most recently with SL Capital, David Currie shares his views on the industry's future.

BPE 3 holds first close at €55m

BPE's third fund, BPE 3, has held a first close on €55m.

BPE exits TSK to trade buyer

BPE has sold German electrical components quality controller TSK Beteiligungs GmbH and its operating company TSK Pruefsysteme to Swiss trade buyer Komax.

Teaching firms how to grow

Education is playing an increasingly pivotal role in a GP's strategy to drive the growth of its portfolio companies. Amy King investigates

Capital Dynamics to close Zurich office

Swiss private equity firm Capital Dynamics has confirmed it will be closing its Zurich office within the next few months, relocating staff to its Zug and London offices.

Software top destination for investment in 2012

A string of major software & computer services buyout deals have made the sector Europe's most invested in since the beginning of 2012, according to unquoteт data.

Quilvest expands in Brazil and Switzerland

Quilvest Group has opened its 12th and 13th offices in Sao Paulo and Geneva.

Onex acquires KraussMaffei for €568m

Onex Partners has acquired German processing equipment manufacturer KraussMaffei for €568m.

Video: Pinebridge's Rhonda Ryan

LP video interview

Demeter 3 Amorçage reaches €43m first close

France-based Demeter Partners has raised €43m for its new cleantech-focused venture fund, Demeter 3 Amorçage.

Acton backs sofatutor.com

Acton Capital Partners has backed online tutoring platform sofatutor.com with a growth equity investment of around €5m.

Chinese hungry for German assets

Recent studies by Rhodium Group and A Capital have suggested that Chinese investors could be in the early stages of a global shopping spree with direct investment into Europe tripling in 2011 to $10bn. With Germany being the most popular market for Chinese...