France

Siparex holds EUR 450m final close for ETI 5

Mid cap-focused fund is 60% larger than its 2017-vintage predecessor and has made four investments

Eurazeo reaps 3.7x money on Orolia exit to trade

Sale of majority stake in French precision electronics group generates EUR 189m in cash proceeds

Apax heads for second small-cap fund with EUR 350m target

French GP seeks private and institutional investors with a minimum commitment of around EUR 100,000

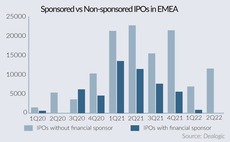

Corporates best placed for autumn IPO window as sponsors sit out

GPs expected to continue to ditch listings in the short term in favour of sale exits, longer holding periods

Unigestion holds EUR 900m final close for fifth secondaries fund

Fund is more than three times the size of its predecessor and is more than 50% committed

Adagia in exclusivity to buy Motion Equity's Minlay

GP beats out Apax, Naxicap in auction final round; deal marks second transaction from its debut fund

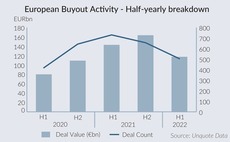

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Apax Partners launches sale of network performance group Infovista

Jefferies and SocGen advise on auction; indicative bids due before summer break

AlpInvest leads Equistone's Sicame continuation fund deal

The deal is Equistone's inaugural continuation vehicle in process first reported by Unquote

Capza launches SME decarbonisation fund with EUR 1.3bn target

Second vintage of the SME-focused strategy will aim to support its portfolio companies with decarbonisation

Earlybird holds Growth Opportunity V first close

Later-stage fund has a EUR 300m target and will mainly back existing Earlybird investments

Equistone, IK invest in PE-backed Safic-Alcan

Paris-headquartered speciality chemical provider’s existing shareholders include EMZ and Sagard

Eurazeo in exclusivity for Sevetys acquisition

French sponsor beats Ardian and Antin in race for a majority stake in French veterinary chain

3i sells Havea to BC-led consortium

BC Partners is acquiring the French natural healthcare group with co-investors PSP and National Pensions Services Investment Management

Capza acquires minority stake in Nutravalia

French food supplements laboratory to seek opportunistic strategic acquisitions

Phoenix Court Group raises USD 500m for four VC strategies

London-headquartered VC is raising for its LocalGlobe, Latitude, Solar and Basecamp funds

GP Profile: Ergon hones in on long-term trends, ESG agenda

The European mid-market sponsor is eyeing growing and resilient businesses with its EUR 800m Fund V

LGT Capital closes first dedicated impact fund on USD 550m

Crown Impact will make co-investments, as well as primary and secondary fund investments

Equistone chooses continuation fund route for Sicame

GP had considered ownership options for the electricity distribution products and services provider

EcoVadis valued at over USD 1bn in Astorg, BeyondNetZero-led round

Deal brings total raised by sustainability rating group to USD 725m; CVC remains largest institutional shareholder

360 Capital holds EUR 45m first close on early stage tech fund

Square II will invest in pre-seed and seed rounds with a focus on French B2B software, consumer disruption, deeptech

Clearwater Multiples Heatmap: PE activity holds up amid war, inflation woes

Record levels of dry powder continue to bolster the resilience of the buyout market in Q1 2022

Advent begins Idemia premarketing ahead of summer sale launch

French biometrics specialist is expected to be marketed off EBITDA of more than EUR 200m

Unigestion launches third Direct fund with EUR 1bn target

Strategy invests in mid-market companies alongside the GP's investment partner network