France

Morgan Stanley equity solutions MD departs

Gautier Martin-Regnier has left after nine years at the bank; expected to join sovereign wealth fund

ICG closes European Corporate fund on EUR 8.1bn

Fundraising exceeds EUR 7bn target set for eight vintage of flagship debt fund

McWin closes EUR 500m restaurant fund backed by ADIA

Food specialist also set to start fundraising for EUR 250m food tech vehicle next month

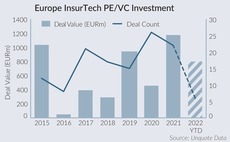

Sidekick spinoffs: Insurtech scale-ups attract PE interest

Investment set to break EUR 1.1bn mark this year as sponsors seek for rising stars

Permira to exit Vacanceselect to PAI-backed European Camping Group

French campsite operator will have approximately 10% market share in Europe after the acquisition

Montagu to exit Arkopharma for EUR 450m

Sale of French supplement maker leaves two unrealised assets in 2010-vintage Montagu IV

IK Partners in exclusivity to sell Exxelia to US trade

Aerospace electronic components group to be acquired by HEICO Corporation for EUR 453m in cash

Tikehau holds EUR 3.3bn final close for TDL V, plans further fundraises

GP said in its H1 2022 results that it has fundraises for its flagship funds in sight for Q3

Tikehau et al. sell majority stake in GreenYellow to Ardian

French sponsors to reinvest in the renewable energy firm following EUR 1.4bn deal

Eurazeo's NAV dips amid volatile markets

Net asset value dips by 3.9% as French sponsor creates contingency buffer of EUR 500m to account for market uncertainty

Deutsche Bank head of EMEA equity-linked departs

Xavier Lagache is no longer in the role after more than a decade; replacement not announced

Oakley to combine Grupo Primavera with Silver Lake's Cegid

Merged software groups valued at EUR 6.8bn; Oakley becomes minority investor alongside KKR and AltaOne

Ambienta plans asset class expansion following EUR 1.55bn Fund IV close

Environmental investor set for first deals with new fund in 2023 as it assesses a foray into new asset classes and geographies, founder and managing partner Nino Tronchetti Provera tells Unquote

Eurazeo PME IV holds 1bn close

Deployment has reached 40% for the new fund, with five to seven further platform investments penned

IK to sell Linxis Group to Hillenbrand for EUR 572m

Agreed sale of packaging machines group to US-based industrial buyer set to complete by year-end

Ardian exits majority stake in Opteven to Apax

New owner will aim to accelerate the insurance provider's international growth

Cinven plays long game with financials fund in hunt for 3x returns

With a life of 15 years, the new vehicle has closed above target, with insurers making up about a quarter of its LP base

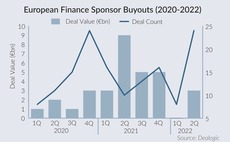

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

Optimism prevails as PEs expect step-up in deal-making – research

Third Bridge's Joshua Maxey speaks to Unquote about the findings of the Mid-market PE Forecast: 2022

Five Arrows-backed A2MAC1 eyes September auction launch

Car benchmarking group could be valued at EUR 1bn in sale likely to attract major tech funds

Five Arrows exits pharmacy group Laf Sante to Latour

Vendor plans to reinvest in pharmacy chain; Bpifrance takes minority stake

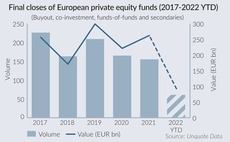

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Final closes down by almost half so far this year, but a number of "mega-cap" vehicles in coming months could still bolster 2022 fundraising

Eurazeo to reap 3.2x money multiple in Vitaprotech SBO to Apax

French GPs in exclusive negotiations for security specialist deal, which could generate IRR of 30%

Cinven holds EUR 1.5bn final close for financial services fund

GP's first sector-focused fund has made three deals, the first of which was insurance broker Miller