Nordics

3i and Allianz looking to sell Scandlines

3i and Allianz Capital Partners are set to sell German-Danish ferry operator Scandlines, according to reports.

Q3 Barometer: European deal flow plummets 35%

Q3 Barometer

TeleVenture et al. invest in APIM Therapeutics

TeleVenture, Sarsia Seed, Birk Venture and Ro Invest are said to have invested in Norwegian preclinical biotech company APIM Therapeutics.

Nordic unquote" October 2012

While new deals in the Nordic region have been hard to come by, even after the end of the summer period, exit activity has picked up the pace.

CapMan creates engineering manufacturer in spinout

CapMan has agreed to spin out elements of its portfolio company Komas's engineering division, which will combine with a division of steel solutions firm Rautaruukki Corporation (Ruukki) through an asset deal to create Fortaco, a manufacturing partner...

Advent acquires Danish KMD from EQT and ATP

Advent International has acquired Danish software solutions company KMD from EQT and ATP Private Equity Partners.

EQT buys Danish Zebra's Tiger

EQT Partners has acquired a 70% stake in Danish retail store chain Tiger via its investment in its parent company Zebra.

360 Capital holds first closing of venture fund

Venture investor 360 Capital Partners has held a first close on its second fund, 360 Capital 2011, on more than тЌ60m.

Sunstone et al. back Freespee

Sunstone Capital and existing investor Inventure have invested тЌ3.3m in Swedish mobile advertising services company Freespee.

Polaris hires investment manager

Danish firm Polaris Private Equity has hired Michael Pontoppidan Frost as investment manager.

EQT buys offshore communication platform for NOK 1.5bn

EQT has acquired offshore communication operator Tampnet from Hitecvision for NOK 1.5bn.

Cashing in on the drive for efficiency

Austerity politics can often seem at conflict with the idealised world of cleantech and renewable energy. With governments scaling back subsidies to reduce their deficits, it might seem that green investing will have slipped out of fashion. However, tough...

Electranova Capital completes first two deals

Electranova Capital, EDF's cleantech investment fund, has completed investments in French electricity management company Actility and Norwegian wind power business Seatower.

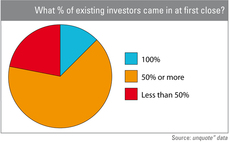

Fundraising research reveals optimism in tough times

Despite talk of apocalyptic investor behaviour, most GPs announcing a close this year reported existing LPs re-upping Т and even increasing ticket sizes, as revealed in an unquote" survey of more than 40 European GPs. Anneken Tappe reports

Video: David Currie - industry needs liquidity

As he steps down from 33 years in private equity, most recently with SL Capital, David Currie shares his views on the industry's future.

Teaching firms how to grow

Education is playing an increasingly pivotal role in a GP's strategy to drive the growth of its portfolio companies. Amy King investigates

Software top destination for investment in 2012

A string of major software & computer services buyout deals have made the sector Europe's most invested in since the beginning of 2012, according to unquoteт data.

Video: Pinebridge's Rhonda Ryan

LP video interview

Carlyle will not ask investors to extend $13.7bn fund

Carlyle Group will not ask investors to extend the investment period for its $13.7bn buyout fund, according to reports.

GMT buys Seagull AS

GMT Communications Partners has acquired Seagull AS, a Norwegian provider of training systems for seafarers, in a management buyout.

European VC "stronger now than in 2000"

Venture capital is on an upward trajectory, with phenomenal exits and a handful of fund closes building momentum. Kimberly Romaine interviews John Holloway, director at European Investment Fund, Europe's largest venture backer, about the industry's decade...

Nordic unquote" September 2012

The Nordic region has performed relatively better this half than the previous one, according to fresh figures from unquoteт data.

New look for unquote" digital editions

unquoteт digital editions have received a major upgrade, providing new features to make using our digital magazines easier than ever. Hereтs a quick guide to getting the most out of them.

Industrifonden backs Anyfi Networks

Industrifonden has invested SEK 9m in Swedish Wi-Fi technology developer Anyfi Networks, alongside the current owners' SEK 1m investment.