Fundraising research reveals optimism in tough times

Despite talk of apocalyptic investor behaviour, most GPs announcing a close this year reported existing LPs re-upping Т and even increasing ticket sizes, as revealed in an unquote" survey of more than 40 European GPs. Anneken Tappe reports

The unquote" fundraising survey asked GPs who are currently out in the market, or recently closed, about their perception of the state of Europe's fund environment. Not surprisingly, an overwhelming 71% stressed that the current economic conditions complicate fundraising significantly.

While traditional LPs such as insurers and pension funds face new regulatory burdens that interfere with their investment plans, the survey found that most GPs attribute LPs' cautious behaviour to risk aversion and general scepticism towards investment opportunities.

In times like these, generalist funds struggle to compete against specialists, with GPs pointing out an appetite for "alternative" alternative structures, such as debt funds and co-investment funds. This is evidenced by a handful of fund closes this year, such as Partners Group's €375m close of Private Markets Credit Strategies 2012 this September, or Idinvest's final close of Idinvest Private Debt in January on €275m and above target.

Venture capitalists, in particular, pointed out that the current sense of risk aversion made fundraising more difficult, but noted that sectoral specifications can help offset this.

But this shake-up of the market should ultimately prove healthy for the European private equity industry. As fewer GPs are able to raise funds and the demand for thorough due diligence increases on the back of more careful risk management and compliance, Europe could become a much safer investment environment.

As EIF's John Holloway said in a recent interview with unquote", those GPs closing funds now are "pretty damn good". Existing investors are key There was a consensus among survey participants that first-time funds, which represented 7% of respondents, had the most difficult time. This is largely because of the need to ensure existing investors create sufficient momentum around first close to entice other, new LPs. This sentiment from GPs is not entirely shared by LPs, some of which point out the fact that first-time funds are likely to be hungrier and also not be distracted by "problem children" in the previous vehicles.

It is taking longer to get LPs to sign. On average, participants counted 3.6 meetings to convince an LP to sign on (again), excluding due diligence and follow-ups. Some noted that institutional investors were much slower in their decision process, driving some GPs to look to family offices and corporates, which are much more agile in their decision making.

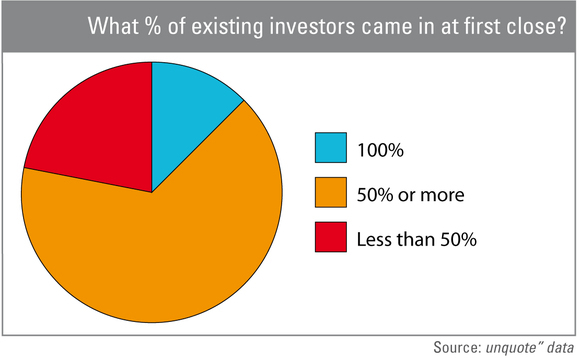

More importantly, the survey results show the importance of good relations with existing investors: more than three-quarters of GPs said 50% or more of their commitments at the time of first close had come from previous contacts (see chart above). Overall, all participants relied on at least one quarter of historical investors for their current fundraising efforts.

So the signs point to risk aversion nudging investors back into the arms of previous investment partners. This does not mean efforts have reduced not only are nearly four meetings required, on average, before LPAs are signed, but some GPs noted that even existing investors demanded a pitch as though it was their first involvement.

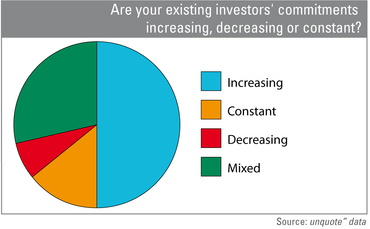

It seems that despite talk of reduced commitments, allocations are actually increasing in size and so perhaps decreasing in number, indicating increased selectivity. Almost half of surveyed GPs (46%) said LPs were increasing their commitments, while only 5% admitted a decrease in investment mandates (see chart above). That explains the significant number of funds noticing an increase in commitments, as well as unquote" reporting so many funds closing 'above target' and 'in record time', as only the top GPs are able to close in this climate. Again, it stresses the importance of relationship management paired with fund management skills.

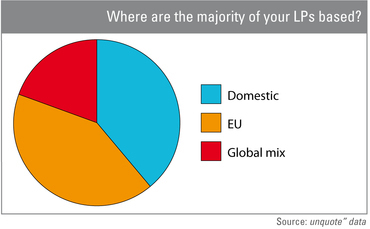

Another by-product of GPs now working with predominantly historical investors and economic woes, is the (re)focusing on domestic markets. More than two-thirds of participants pointed out that their LPs were domiciled in the same domestic market (34%), or within the European Union (37%, see chart below). This also shows that stricter regulation on funds investing throughout Europe has not yet had a visible effect. In fact, some participants argued that private equity allocations could benefit from new regulation as they become more attractive versus public investments in the long term.

Terms and conditions

Since the financial crisis, LPs have been more outspoken about their demands from GPs. Co-investment rights are a big deal in many fundraising processes, both for primary and secondary funds. That said, most survey participants have not altered terms and conditions since their previous fund. However, among the 27% of GPs who did change their terms and conditions, there was a move towards more LP-friendly terms. They noted that the economic conditions put more pressure on management fees in the light of returns and the generally perceived capital shortage.

It is not the easiest time to raise a fund, but working with previous investors helps, alongside a solid investment model. For LPs, it is a question of trust, for GPs, it is a matter of survival. But the increasing commitment of investors in managers they have supported in the past should not be misunderstood as an indicator of a more robust fundraising environment. In context, it shows the opposite, as some GPs cannot even bring their funds to first close and are forced to abandon their efforts halfway through. Strengthened ties between GPs and LPs suggest that the crisis is consolidating the market. In the best case scenario, the dire conditions will nurture a healthier and more efficient private equity market in Europe, based on trust and ability, and which can withstand competition from Asia and South America.

The unquote" fundraising survey is a seven-question qualitative survey among GPs targeting Europe who are currently fundraising or have closed their latest fund in the past 18 months. The survey was conducted throughout August and September 2012.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds