Nordics

Priveq backs MBO of Office Management

Priveq Partners has taken a majority stake in Swedish office supplier Office Management.

Sentica acquires Silta

Sentica Partners has taken a majority stake in payroll consultancy Silta.

Scandinavian banks downgraded by Moody's

Moody's has downgraded some of the most popular private equity debt providers in Scandinavia.

Viking Venture exits myVR

Viking Venture has exited Norwegian software company myVR to Swedish trade player Hexagon.

Tax authority demands Nordic Capital execs repay SEK 412m

Nordic Capital executives have been ordered to repay SEK 412m in carried interest tax, after the Swedish tax authority reached a final verdict in a lengthy investigation.

Norway joins carried interest tax push

The Norwegian tax authority will classify carried interest as standard income, putting a few hundred million NOK of carried interest at risk.

Nordic Capital acquires Tokmanni from CapMan

Nordic Capital has acquired Finnish discount retailer Tokmanni Group from CapMan.

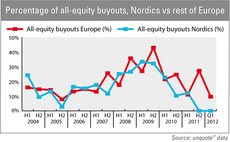

Nordic credit remains more readily available

The Nordic countries have enjoyed a lower proportion of all-equity buyouts than the rest of Europe for several months now - highlighting easier access to leverage in the region.

PEQ backs Inläsningstjänst MBO

PEQ has backed an MBO of educational services provider InlУЄsningstjУЄnst.

Buyout houses circle €1bn Global Blue

EQT, BC Partners, TH Lee Partners, Silver Lake Partners and Partners Group have reportedly entered a second round of bidding for Equistone's tax-free retail services company Global Blue.

Lawyers: your most valuable asset?

Lawyers: a valuable asset?

Finnish Industry Investment commits €7.5m to Creandum III

Finnish Industry Investment has made a тЌ7.5m commitment to Creandumтs latest venture capital fund.

Nordic unquote" May 2012

Despite reputational, regulatory, and macroeconomic concerns lingering from the second half of 2011, the Nordic private equity market has experienced its strongest first quarter since Lehman Brothers collapsed and brought the global economy to its knees....

Fouriertransform invests in ArcCore

Sweden-based venture capital firm Fouriertransform has invested SEK 10m in Swedish software developer ArcCore.

Bain Capital buys Bravida in tertiary buyout

Bain Capital has bought Swedish technical installation and services solutions company Bravida from Triton Partners in a tertiary buyout.

Litorina exits Tolerans

Litorina has divested Swedish stitching systems company Tolerans to CEO Jan Melin and a consortium of investors.

Fundraising activity up by 80% in 2011

European private equity and venture capital fundraising increased by 80% in 2011, according to recent figures released by EVCA.

Polaris-backed Alliance+ bolts on Miljöteamet

Polaris portfolio company Alliance+ has acquired Swedish cleaning services business MiljУЖteamet.

Almi in SEK 12m round for Arkub

Almi Invest has taken part in a SEK 12m funding round for Swedish telematics company Arkub.

High yield to revive Europe's loan market

High hopes for bonds

Nordic Capital et al. sell Nycomed spinoff Fougera for $1.5bn

Nordic Capital, DLJ Merchant Banking Partners (DLJMB), and Avista Capital Partners have sold US-based Nycomed spinoff Fougera to Swiss trade player Novartis for $1.525bn.

Connect Ventures holds €16m first close

Newcomer Connect Ventures has held a тЌ16m first close for its maiden early-stage fund.

Video: Pantheon's Hadass talks fund selection

Nowadays current portfolio performance is a strong gauge of future fund performance. Kimberly Romaine interviews Pantheon's Leon Hadass.

Permira eyeing Nokia luxury phones

Permira is looking to pick up luxury phone manufacturing business Vertu from Nokia, reports suggest.