Nordics

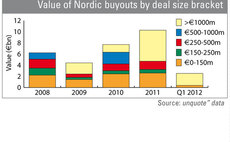

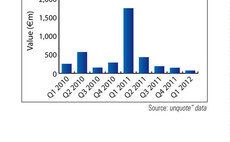

Nordics see strongest first quarter since Lehman

Despite reputational, regulatory, and macroeconomic concerns lingering from the second half of 2011, the Nordics has experienced its strongest first quarter since Lehman Brothers collapsed and brought the global economy to its knees.

Reiten & Co exits Ellipse Klinikken

Reiten & Co Capital Partners has exited cosmetic treatments provider Ellipse Klinikken to Swedish private clinic chain Akademikliniken.

Nordics seen as investment safe haven

The тЌ1.8bn sale of Ahlsell to CVC Capital Partners in February drew renewed attention to the thriving Nordic buyout market.

Incitia backs Campadre

Incitia Ventures has taken a minority stake in Swedish online private sales company Campadre Scandinavia.

Enterprise Investors injects €5.5m into BLStream

Enterprise Investors has injected тЌ5.5m into Finland-based software company BLStream in exchange for a 35% stake.

Industrifonden and SEB VC sell Coresonic

Industrifonden and SEB Venture Capital have divested their stakes in Swedish technology company Coresonic to Gaintech, a subsidiary of Taiwanese trade player MediaTek.

Nordic sentiment: have your say

The Nordic private equity market has hit a few bumps in its road to recovery, with taxation issues overshadowing the regionтs otherwise impressive growth.

SVCA conference tackles industry reputation

Regulation and reputation were top of the agenda as private equity professionals gathered for the SVCA conference in Stockholm. Sonnie Ehrendal reports

Advent International appoints new advisers

Advent International has appointed two new advisers for its business in Norway.

Notion Capital holds a $100m first close

Notion Capital has announced a $100m first close for Notion Capital Fund 2, its second fund focused on emerging cloud computing and software-as-a-service (SaaS) companies in the UK and Europe.

Industrifonden and SEB Venture back Clavister

Industrifonden and SEB Venture Capital have backed Swedish IT security firm Clavister with a SEK 40m investment.

Stirling Square acquires SAR

Stirling Square Capital Partners has acquired Norwegian oil and gas services provider SAR from previous owners AR Incoronato and Westco.

Swedish carried interest taxation could be dropped

Swedish proposals on the taxation of carried interest are likely to be dropped after opposition parties called for tougher rules.

CapMan's Eastavab merges with Swedish Starlight

CapMan audiovisual equipment rental and event organising company Eastavab will merge with Swedish trade player Starlight.

CEE activity: bottomed out?

Next weekтs CEE unquoteт Congress will reveal reader sentiment for CEE prospects.

Advent hires two to Nordic team

Advent International has appointed two new independent advisers in Norway, Birger Nergaard and Gunnar Rydning.

Nordic unquote" April 2012

Swedish life assurer and private equity LP Skandia Liv has received the go-ahead to buy its parent company Skandia from Old Mutual for SEK 22.5bn.

EQT appoints new adviser

EQT Partners has appointed ex-Deutsche Bank board member Michael Cohrs as adviser.

Novo and Almi in SEK 25.5m round for Denator

Novo Seeds and Almi Invest have participated in a SEK 25.5m financing round for Swedish biotech company Denator.

Symphogen receives second tranche of €100m investment

Danish biotech company Symphogen has received a second tranche from the тЌ100m investment it received in 2011.

RIT sells Agora Oil and Gas for $450m to Cairn Energy

RIT Capital Partners have exited Norwegian oil and gas company Agora for a total of $450m, with ТЃ73m in total profits.

Business Growth Fund: Myth versus reality

The newest kid on the block т made up of lots of the old boys in the industry т is struggling to make friends. People say the Business Growth Fund (BGF) is too big and too threatening. But is the BGFтs reputation warranted? Kimberly Romaine investigates...

PE firms in 2nd round for Triton's Bravida

Four private equity firms have entered a second round of bids for Triton portfolio company Bravida, reports suggest.

EQT buys Anticimex from Ratos

EQT has acquired 100% of the Anticimex Group from Ratos in a tertiary buyout.