Nordics

Nordic buyouts set to return to 2007 levels

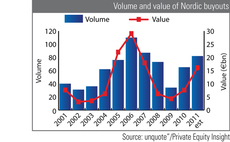

Buyout activity in the Nordics could return to levels seen in 2007, according to unquoteт research. If Nordic deal activity continues at the pace seen in the first half of 2011, volume and value look set to fall just short of 2007 levels, marking a resurgence...

Sponsor Capital et al. sell Lujapalvelut

Sponsor Capital, Varma and other shareholders have sold Finnish facility management company Lujapalvelut Oy to Coor Service Management.

Industrifonden et al. invest SEK 9m in SEEC

Industrifonden, STING Capital and ALMI Invest have invested SEK 9m in SEEC, a company that develops, markets and sells energy stores with energy modules for large buildings.

Moulton: Industry mergers to create fewer, larger players

A tumultuous few years as well as increased legislation will lead to the consolidation of the industry into a smaller number of larger buyout houses via mergers. Unquoteтs Kimberly Romaine talks to Jon Moulton, Chairman of Better Capital.

FII et al. invest €2m in Multitouch

Finnish Industry Investment (FII) and Veritas Pension Insurance have invested тЌ2m in Finnish interactive display developer Multitouch Ltd.

UK activity surges in July after slow start

Following a rather lacklustre start to 2011, the UK has seen a sudden spike in private equity investment activity this summer, and professionals will be hopeful this can continue through the rest of the year.

Intel Capital launches Ultrabook Fund

Intel Capital, the private equity arm of computing hardware provider Intel, has announced the launch of its Ultrabook Fund with a $300m target.

A third of deals in doubt from September

Recent changes to the Takeover Code would have impacted 32% of UK deals since 2005. But if properly considered, P2Ps will still be do-able. Kimberly Romaine reports.

Ratos appoints Kristina Linde as accounting head

Ratos has appointed Kristina Linde as its new head of accounting.

Private equity 'at risk of outbidding by trade'

Financial buyers such as private equity funds are leaving themselves exposed to being outbid by strategic trade purchasers, corporate finance lawyer Garrett Hayes said today.

Interview: Javier Echarri

Having spent 10 years at the helm of the European Venture Capital Association (EVCA), Javier Echarri is roundly considered one of the world's most influential people in private equity. He talks to Susannah Birkwood about the AIFMD, national trade bodies...

Pandora IPO lifts lid on PE failings

Pandora is not the only private equity-backed IPO to suffer т it would seem the box is full of underperforming listings. John Bakie reports.

Reiten-backed QuestBack acquires Globalpark

Reiten & Coтs portfolio company QuestBack AS has acquired and merged with German social CRM vendor Globalpark AG.

Industry fears confirmed as BGF outbids NVM

The Business Growth Fundтs outbidding of private investor NVM appears to justify market concern that the vehicle constitutes unfair competition to smaller PE houses.

Waterland's fifth fund raises €1.1bn

Waterland Private Equity Investments has held final close of its fifth fund, Waterland Private Equity Fund V, at тЌ1.1bn.

Proskauer Rose poaches three for funds team

Proskauer Rose has poached three private equity fund structuring professionals from rivals Kirkland & Ellis and SJ Berwin in recent days, in anticipation of increased fundraising activity.

Niklas Eklund joins Wellington Partners

Wellington Partners has appointed serial entrepreneur Niklas Eklund as a venture partner.

Consortium sells Carmel Pharma stake

A consortium, consisting of Priveq Investment, Investor Growth Capital, Industrifonden, Start Invest and employees, has sold 95% of the shareholding in Swedish pharmaceutical company Carmel Pharma AB.

Valedo closes second fund on SEK 2bn

Valedo Partners has closed its second fund, Valedo Partners Fund II, on SEK 2bn.

Valedo acquires Corbel from Sentica

Valedo Partners has acquired real estate management services provider Corbel Oy from Sentica Partners.

Secondary players dominate Italy's foreign LP base

Italian GPs ought to be doing more to attract foreign investors at the fundraising stage, as many of the country's overseas-based LPs are secondary players. Susannah Birkwood finds out whether this and other local trends are about to change.

Ratos' Canal Digital add-on gets a no-go

Ratos has decided not to pursue the bolt-on of Canal Digitalтs cable-TV operations for portfolio company Stofa.

Riverside adds two new execs

Global private equity firm The Riverside Company has appointed two new executives, Juan Rufilanchas and Jaime Escribano, to its Madrid office.

Perusa Partners acquires Dynasafe

Private equity firm Perusa Partners has acquired explosion containment equipment supplier Dynasafe International AB.