Nordics

Harper to lead HIG's London small-cap buyout team

Prior to joining HIG, John Harper was a partner at Inflexion Private Equity and previously worked at LDC

Nordic e-commerce confident "silver krona" uplift will persevere

Lockdowns have т out of necessity т introduced a new age group to online shopping, boosting prospects for several PE-backed assets

Cimbria acquires Danish software company APX10

Cimbria Nord buys the two-year-old business from Danish organisation Hedelskabet

BNP Paribas Euro SME Debt Fund II holds €576.5m final close

Investment period for the GP's тЌ500m predecessor debt vehicle ended earlier in 2020

Baudon to remain Invest Europe chair, EBRD's Fossemalle named chair-elect

Fossemalle has been the director in charge of equity funds at the EBRD since 2009

Connect Ventures closes $80m seed fund

Fund deploys capital in companies operating across all B2B and consumer software segments

FSN wins €87m in arbitration ruling against Procuritas

Ruling comes two years after FSN sued Procuritas in relation with the Gram Equipment transaction

Mediobanca, Russell Investments launch third private market fund

Fund invests in secondaries, distressed assets and opportunities in dislocated industrial sectors

Video: Cambridge Associates' Marcandalli on impact investing moving centre stage

In a new instalment of Unquote's Lockdown series, Annachiara Marcandalli explains why it is unlikely that coronavirus will sideline impact investing

Buy-and-building through the storm

Bolt-ons remain one way of deploying capital and building value, but a tough financing market and pricing mismatches make for a challenging landscape

From PE darling to hard-hit sector: gyms face uncertain post-covid future

As gyms and fitness clubs across Europe gear up to welcome back consumers, Unquote explores their tricky path out of lockdown

BlackRock and ApoBank launch healthcare fund

BlackRock-managed fund aims to give ApoBank's institutional clients access to healthcare investments

EQT sells credit business to Bridgepoint

There were five or six bidders in the early stages of the sale auction, including Schroders

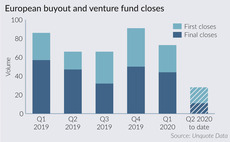

European fund closes slump by 42% amid lockdown

Unquote recorded 44 first or final closes of European PE funds between March and May, a 42% drop on the three-month average seen across 2019

Lifeline in €6.2m round for Tilt Biotherapeutics

Healthcare startup has raised тЌ18m in funding since its foundation in 2013

Meta Change Capital launches €100m fund

Fund is dedicated to investments in blockchain companies across Europe, Asia, the Middle East and Africa

CapMan to launch first Special Situations fund after summer

Nordic private equity firm CapMan has launched CapMan Special Situations to focus on turnarounds.Т

Main Capital-backed Alfa acquires Joliv

GP plans to merge Joliv and previously acquired e-health business Alfa

Tesi et al. in $40m series-B round for Swappie

Company has so far raised $48m and saw a fivefold increase in revenues during the lockdown period

Secondaries players weigh up risk and rewards of "ring-fencing" deals

GP-led transactions isolating assets hardest hit by the Covid-19 crisis could appeal to adventurous secondaries players, but challenges abound

The Deals Pipeline

A fortnightly highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

EQT to sell Hector Rail to Ancala

Company's revenues have grown by 80% during EQT's holding period

Francisco Partners to acquire Consignor – report

Shipping software company was reportedly marketed based on an EBITDA of тЌ7.5m

Kinnevik to sell 23.2% stake in Qliro to Rite Ventures

Deal will make Rite Ventures the largest owner of the Nordic e-commerce group